Those who are declaring crypto is dead might want to check the charts. Bitcoin has appreciated by more than 75% so far this year, climbing from a level of US$16,540 as of Jan. 1 to US$29,218 as of April 30. Over that period, it’s beaten the Morningstar US Market Index by a whopping 69 percentage points.

There are a few possible reasons for this. Bitcoin underwent a software upgrade late last year that opens its blockchain up to other use cases besides payments, which might have stirred up some interest. As the financial ecosystem around crypto has crumbled, it’s possible that the faithful have returned to their mother ship and stashed their assets where they know they won’t be touched. Gold has also rallied over that same stretch, leading some analysts to conclude that investors more broadly are looking for alternative stores of value as trust in financial institutions has ebbed after the regional bank failures that peppered the first few months of 2023.

Any of these reasons might be compelling, but only because other potential bitcoin investors find them meaningful. Right now, bitcoin is still a bit of a mirror: People will see what they want to see. Returns of 50% are possible because there are very few contrarians in crypto.

Unfortunately, this is equally as true on the way down as it is on the way up. Bitcoin will continue to cycle through boom after bust so long as there’s no good way to value it. Only with cold hard numbers in hand can investors start to probe at the narratives that dominate crypto.

This article represents Morningstar’s first attempt to do so. We will cover four common valuation exercises and evaluate the suitability of each as it relates to bitcoin.

4 Methods for Modeling

There are four popular models for proxying the value of bitcoin that hail from traditional stock valuation.

Two measure demand:

- Total Addressable Market

- Network Effects

Two measure supply:

- Cost of Production

- Stock-to-Flow

We will examine the other three models in future pieces; the balance of this article will focus on total addressable market.

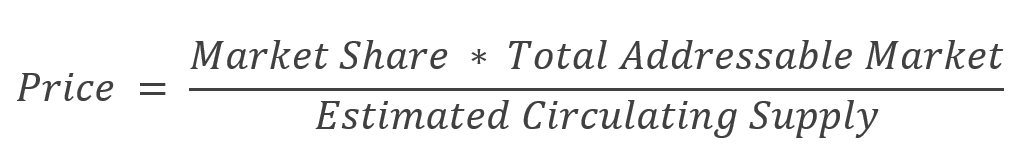

Investors using the total addressable market method take an existing product or industry and estimate the size of that market. From there, they will estimate how much market share a new product could capture, giving them a rough idea of how much it could be worth to consumers.

Investors might recognize this approach from firms touting that bitcoin could someday displace gold as a store of value. Why all the focus on gold? Primarily it is because, like bitcoin, gold has a theoretical fixed supply. There will only ever be 21 million bitcoins, and miners have already minted roughly 19 million as of May 2023; roughly 209,000 tons of gold have ever been mined, leaving approximately 52,000 tons in the ground as of February 2023.

There are practical reasons to discount this argument, which we have made before. But the narrative persists, with some analysts tempering their assumptions to reach more-reasonable valuations. Even if bitcoin captures just 10% of the market for gold, the thinking goes, it could reach prices as high as US$154,000.

For now, let’s put aside the theory and focus on the math. One problem with that back-of-the-napkin estimate is that gold has another major application that gives it value and scarcity: jewelry. The World Gold Council estimates that jewelers have claimed about half of the world’s aboveground supply of gold.

As an intangible asset, bitcoin cannot compete with gold on that front. So what we’ve done is scrape that stock from our estimate of the available supply to focus exclusively on financial use-cases. (We assume that no consumers are purchasing gold jewelry to use it as a store of value. We also assume that all nonjewelry storage can be classified as an investment. Both of these assumptions are likely not 100% true, but such are the risks of simple models.)

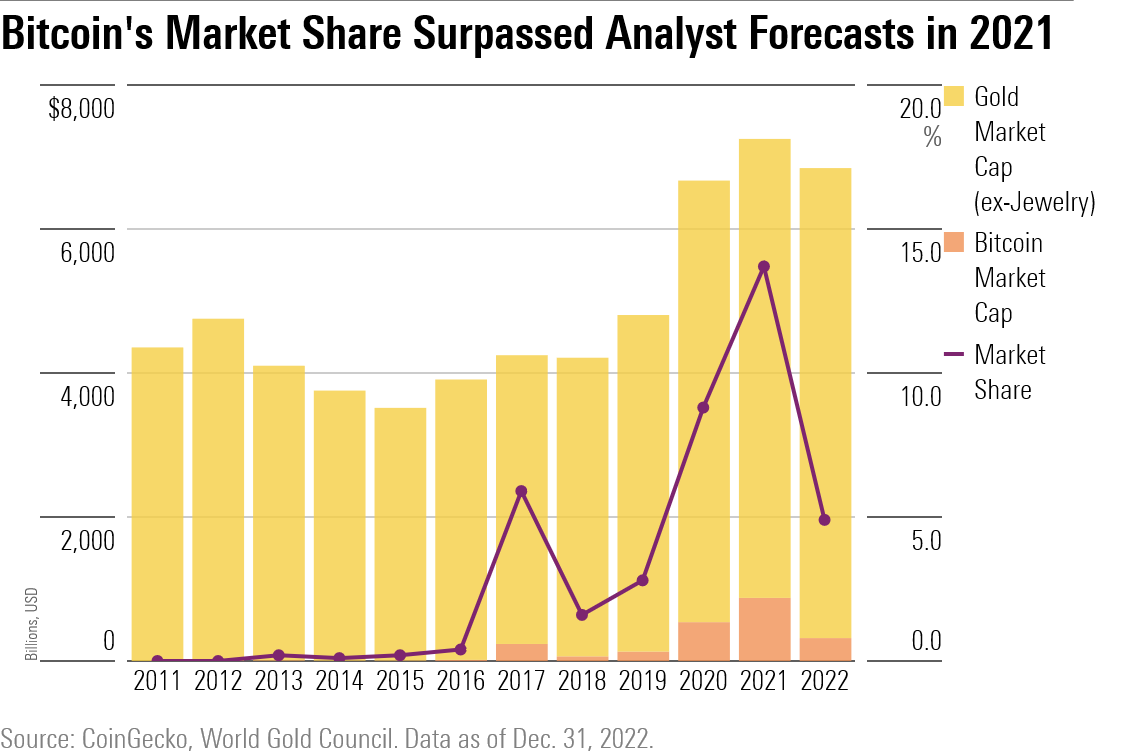

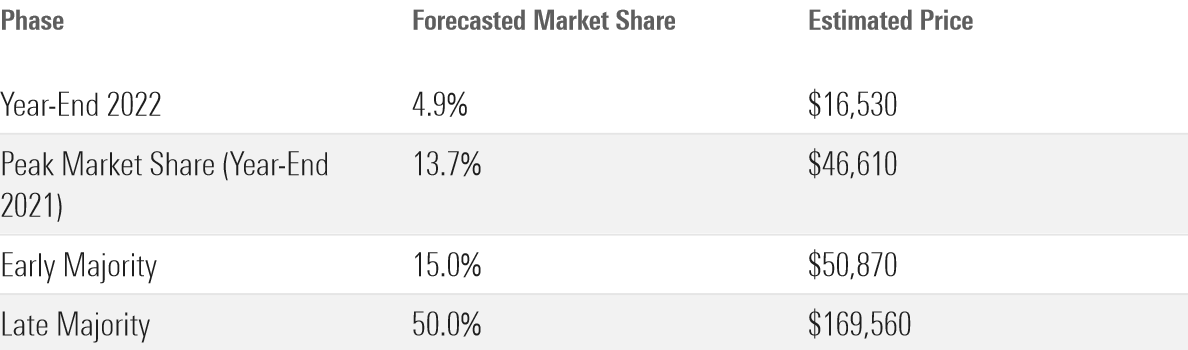

After adjusting for jewelry, our math suggests that bitcoin has attained much greater penetration of the “store of value” market than other studies claim. At year-end 2022, bitcoin had a market capitalization of around US$318 billion. The world’s financial holdings of gold totaled about US$6,528 billion, which means that bitcoin soaked up 4.9% of gold’s market share as a store of value in 2022. Interestingly, bitcoin already passed the forecast 10% threshold back in 2021.

From here, an analyst would typically pick a terminal market share and multiply that by the size of the industry to forecast how much a product can grow.

So, how much bigger could bitcoin get? The unvarnished truth is that no one knows. If we ask Cathie Wood, bitcoin could eclipse 100% of gold’s market cap. If bitcoin recouped its losses and nabbed back 10% of gold’s market share, that would imply a price of US$33,910. But market share could also fall back down to less than 2%, where bitcoin has floundered for most of the 2010s, if retail interest continues to dwindle after the slew of crypto blowups of 2022.

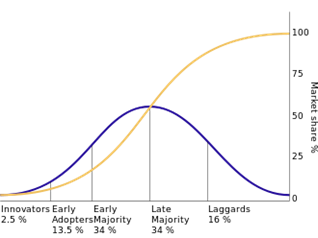

Rather than relying on guesswork, we will try to apply some rigor to the forecast by using history as a guide. The S-Curve was created by a rural sociologist named Everett Rogers in the 1960s to explain how innovation spreads. It has since become a cornerstone for modeling the rate of adoption for new technologies in a wide range of disciplines, from cancer prevention techniques to social networks.

The S-Curve models adoption along several distinct phases. Each phase is denoted by the audience it represents: innovators, early adopters, early majority, late majority, and laggards. Rogers starts with a normal distribution of the entire market, segmenting it across each one of these categories. To build an S-Curve, the populations accumulate, so that the market share of a particular product equals some percentage of the audience it is currently expanding to, plus all of the groups that came before it.

By this metric, with a 4.9% market share, bitcoin is still in the throes of the early adopter phase. If it crossed over into the early majority phase, it would reach a price of $50,870. If it was to reach the late majority phase, it could surpass $169,000.

Given how simple they are, there are inherent flaws to relying on S-Curves for financial securities.

- S-Curves assume that adoption is cumulative. Put another way, this would imply that users who adopted the technology in an earlier phase do not abandon it. We know from experience that that’s not true: Bitcoin’s market share declined to 4.9% from 13.7% in just a year.

- Users are the unit of measurement for S-Curves, and the model assumes that the relationship between additional users and additional market share is 1:1. This relationship is intuitive for products. If you purchase a PC from Dell, for example, Dell’s revenues will usually increase by the price of that computer. For financial assets, this assumption is a bit more of a reach. It implies that every additional bitcoin wallet opened pushes up bitcoin’s price by a constant amount—a highly improbable condition.

Even once we plug in a forecast market share, using the total addressable market model to derive a price introduces additional wrinkles.

- We assume that the suggested total addressable market, measured by gold’s nonjewelry market capitalization, stays fixed over time.

- We also assume that bitcoin’s current circulating supply would also be its future circulating supply.

These two assumptions are clearly oversimplifications. We know that this is not how these assets work in practice: Gold’s market capitalization grew by 3.7% annualized over the past 12 years, and bitcoin’s circulating supply increases every day as miners approve new blocks.

While these assumptions may not be true, they can still be useful. That’s because they point to something important about the design of a total addressable market model: Although there are certainly tweaks that investors can make, it’s not inherently a time-varied approach. There is no end date unless the analyst defines one. That’s a problem because it’s not particularly informative to try to ascribe a future value to an asset when that future remains undefined.

:quality(80)/cloudfront-us-east-1.images.arcpublishing.com/morningstar/5FNGF7SFGFDQVFDUMZJPITL2LM.png)

:quality(80)/cloudfront-us-east-1.images.arcpublishing.com/morningstar/EOGIPTUNFNBS3HYL7IIABFUB5Q.png)