Tesla’s (TSLA) board should analyze the impact on investors if CEO Elon Musk or other key officials leave the company, a shareholder is proposing. Morningstar Sustainalytics, in a report, is advising investors to support the proposal at Tesla’s May 16 annual meeting.

The shareholder proposal asks the board to prepare and disclose a report on Tesla’s so-called key-person risk. That means the board would identify key persons, like Musk, on whom the company is overly reliant—and whose absence or behavior would affect the firm’s value. In addition, it says the report should have procedures for dealing with key-person risk. They include identifying the key persons, training successors, and mitigating the financial impact of the loss of a key person. The proposal was made by Karen Robertsdottir, a shareholder in Reykjavik, Iceland.

Some Examples of Key-Person Risk

Key-person risk isn’t unfamiliar in the corporate sector. Consider Berkshire Hathaway (BRK.A) and its founder, Warren Buffett, widely considered to be one of the greatest investors of all time. Berkshire investors expect shares to come under pressure if and when Buffett dies or if he becomes mentally incapacitated. Berkshire is a prime example of key-person risk: After all, ratings agencies have downgraded Berkshire in the past precisely because of it.

Sometimes, key-person risk arises from CEO misconduct. Consider the case of Carlos Ghosn, the chair of Renault, Nissan, and Mitsubishi Motors, who was accused of underreporting his compensation. Ghosn is now a fugitive in Lebanon.

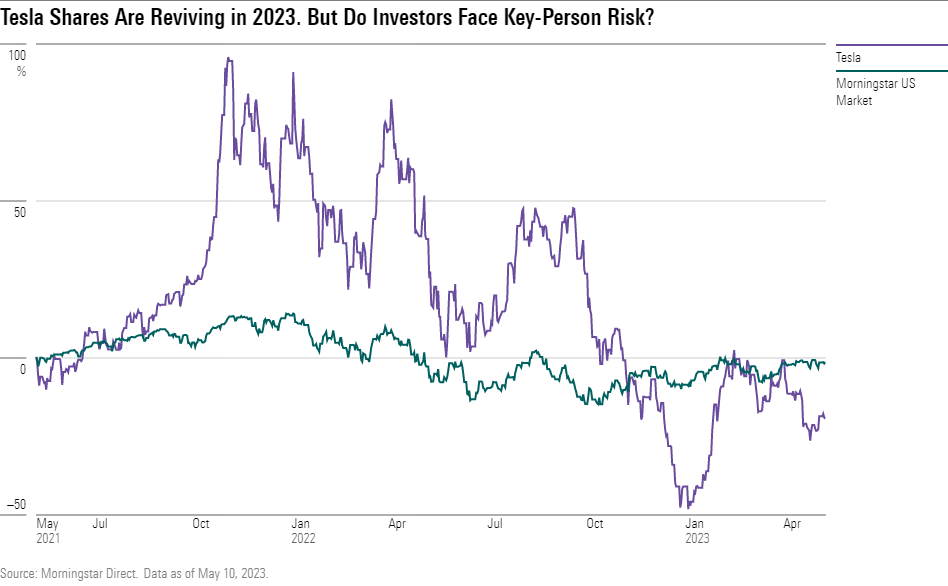

And the fortunes of companies, like Tesla, can be overly tied to a CEO’s actions. Tesla’s shares fell sharply in April 2022 as news emerged that Musk was interested in buying Twitter. Since then, Musk has become Twitter’s CEO, and reportedly pulled dozens of Tesla engineers to reshape Twitter. News that Musk found a new CEO to replace him at Twitter lifted Tesla shares.

Underperformance Can Follow Key-Person Risk

Indeed, underperformance often accompanies key-person risk. Shareholder Robertsdottir cited a 2018 Morgan Stanley report that found that in 2017 59 S&P 500 CEOs left their companies. These companies then underperformed the market by 11% in the subsequent 12 months.

“In light of widespread concerns that Tesla’s board does not exercise effective oversight of its CEO and, as a consequence, the significant key person risk that Tesla’s shareholders face, we recommend a vote in support of this resolution,” Sustainalytics wrote.

In an interview, Jackie Cook, the author of the Sustainalytics report and director of stewardship at Sustainalytics, said the proposal “succinctly summarizes some of the core governance problems at the company.”

Tesla opposes the shareholder proposal. It says the board and company management are best equipped to carry out succession planning and handling day-to-day hiring, promotion, and termination decisions. It also says that adopting the proposal would cause competitive harm to Tesla.

Nevertheless, in its most recent 10-K report, Tesla identifies key-person risk and says, “In particular, we are highly dependent on the services of Elon Musk, Technoking of Tesla and our Chief Executive Officer.”

Other Tesla Shareholders Recommend Voting Against New Board Nominee

Separately, a group of Tesla investors are recommending that shareholders vote against a new board nominee, J.B. Straubel, arguing that Straubel is a company insider who wouldn’t increase board independence. Straubel is a Tesla co-founder and former chief technology officer who is CEO of privately held battery company Redwood Materials.

In an SEC filing, the group says Tesla’s board already “has strong ties to CEO Elon Musk, with his brother, Kimbal Musk, and Ira Ehrenpreis and James Murdoch, who count themselves as his personal friends, serving as directors.” The group said the board’s current weakness allowed it to rubber-stamp a $56 billion pay package to Musk in 2018, which the Delaware Court of Chancery said should be regarded with “heightened judicial suspicion” owing to the conflict of interest between the approval of the pay package and Musk’s status as a controlling shareholder.

The group includes Nordea Asset Management, Pension Danmark, NIA Impact Capital, SOC Investment Group, and others.

Musk’s Twitter Adventure Shows Key-Person Risk

The proposal “might have a good chance to pass,” Morningstar strategist Seth Goldstein said in an interview. “If Musk stepped down operationally, I think it’s a risk for the stock.” For example, Goldstein relates, when Musk purchased Twitter, Tesla’s stock fell. When Musk made politically charged tweets, Tesla’s stock also fell on worries that his tweets would drive away consumers, the analyst continues. Currently, Goldstein rates Tesla as undervalued.

In the past, Tesla has responded to some shareholder proposals. For example, after Calvert Research & Management, a unit of Morgan Stanley, was supported by a majority of shareholders on a proposal asking Tesla to provide more data about its diversity, equity, and inclusion efforts, Tesla provided detailed EEO-1 data from its filings with the U.S. Equal Employment Opportunity Commission.

Even for non-Tesla investors, Tesla’s annual meeting is “the most interesting” of the season, partly because of the key-person risk proposal as well as Tesla’s decision to change the date of its annual meeting by several weeks, making it difficult for shareholders to file other proposals, Cook of Sustainalytics says.

:quality(80)/cloudfront-us-east-1.images.arcpublishing.com/morningstar/5FNGF7SFGFDQVFDUMZJPITL2LM.png)

:quality(80)/cloudfront-us-east-1.images.arcpublishing.com/morningstar/EOGIPTUNFNBS3HYL7IIABFUB5Q.png)