Frontier equity funds appeal to Taiwan investors who look to diversify their portfolios. One example was Vietnam equity--the favorite fund category among Taiwan investors in July. This category was only first offered to local investors in August 2020 and ranks as the top-10 category that gathered most assets so far in 2021.

Exhibit 1: Vietnam Led the Fund Inflow Versus Outflow From Bonds

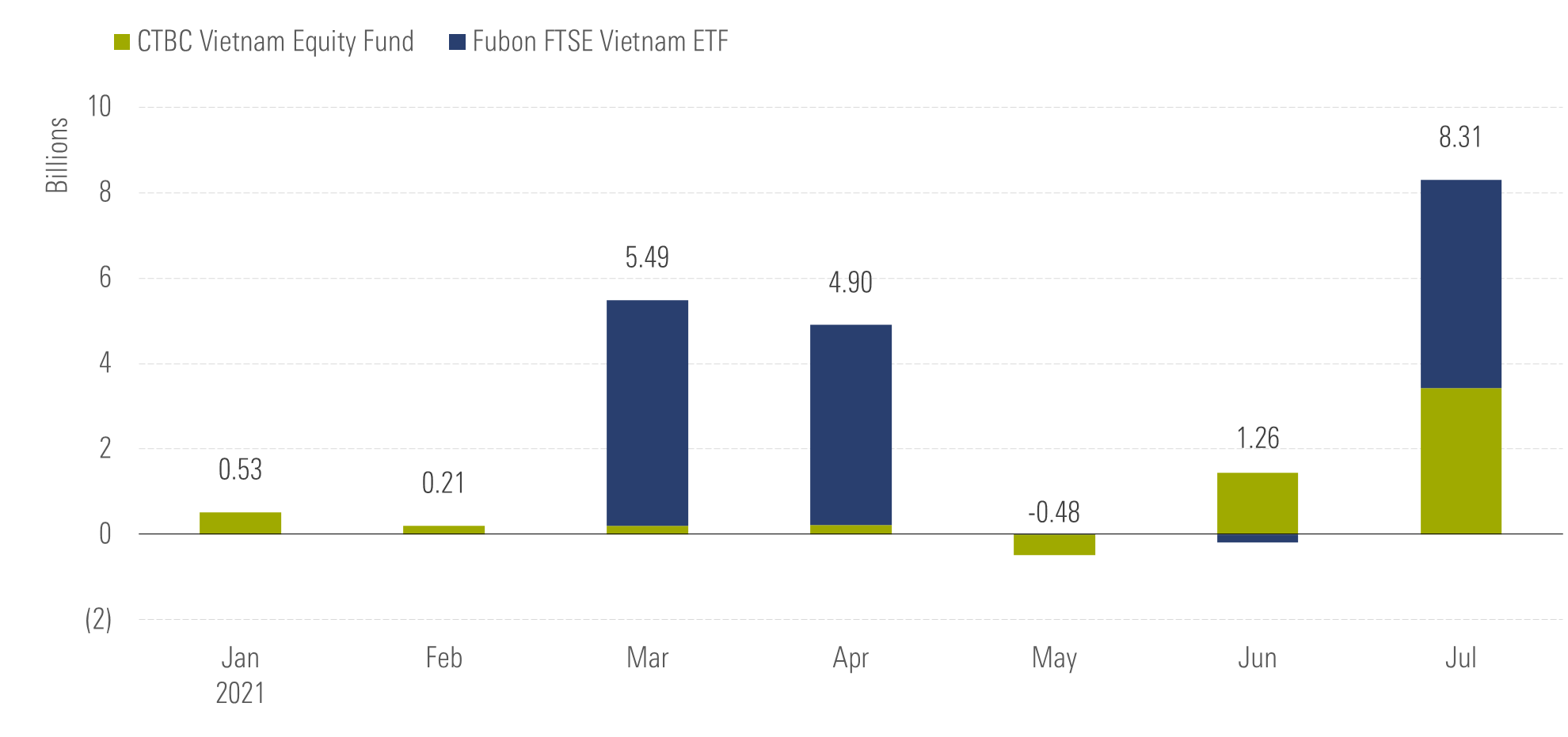

Currently, the category only consists of two funds: CTBC Vietnam Equity Fund TW000T2691B9 and Fubon FTSE Vietnam ETF 00885. CTBC Vietnam Equity Fund, with an inception date of August 2020, was also the best-selling mutual fund in July. Including the TWD 8.3 billion net subscriptions in July, the two funds gathered TWD 30.8 billion under management.

Exhibit 2: Estimated Net Flows Into Vietnam Equity Funds in Taiwan

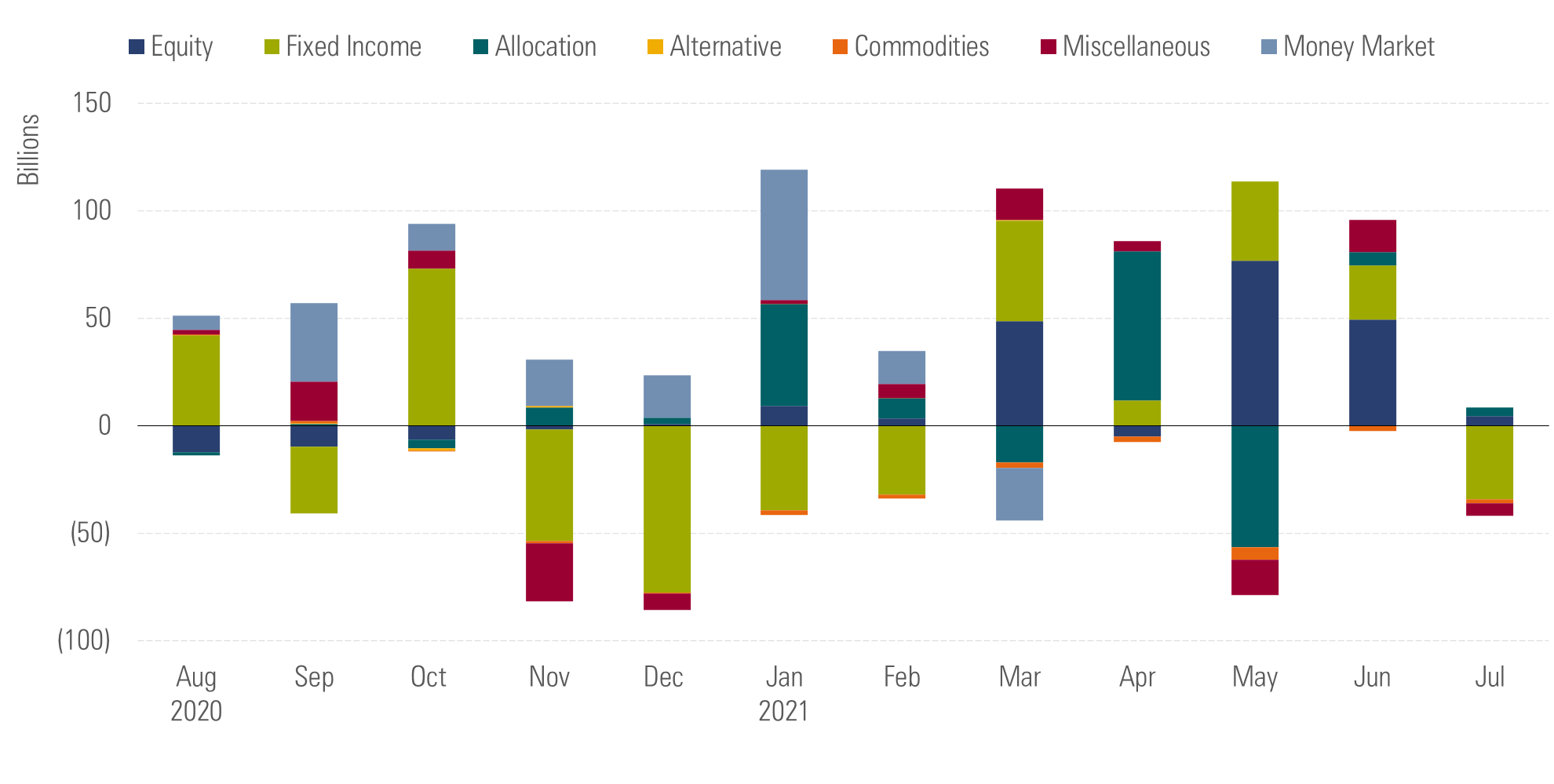

The broader market experienced a slower flow activity compared with the past months. Morningstar Direct data showed thatfunds domiciled in Taiwan received a net outflow of TWD 9.9 billion in July. Excluding the inflow into money market funds, investors pulled TWD 36.8. million out of the market, making it the worst single-month outflow so far in 2021.

Exhibit 3: Overview of Funds Domiciled in Taiwan

Exhibit 4: The July Fund Flow Was Relatively Quiet for Taiwan Funds

Equity Slows, Bond Bleeds

In July, equity funds absorbed assets at a slower rate than the previous months. In total, the equity category gathered TWD 4.6 billion, versus TWD 49.4 billion in June and TWD 76.9 billion in May. The major drag came from fixed-income products as Taiwan investors redeemed funds from several Morningstar categories (Exhibit 2).

Out of the 10 most-sold fund categories, six came from bond funds. U.S.-dollar-denominated corporate bond funds had the largest net redemption of TWD 14.6 billion, followed by other bond and USD government-bond funds.

Leverage and inverse products investing in equity and other assets, which are typically used in very short-term directional trades, experienced a total outflow of TWD 6.8 billion in one month. Fixed-income Leverage and inverse products ended July with a TWD 1.3 billion inflow.

Taiwan's large-cap equity, which was the best-sold category in the past months, lost steam in July. Adding to July’s total outflow of TWD 2.5 billion, Taiwan large-cap equity funds remained the category that has gathered the most assets year to date, totaling TWD 72.1 billion.

By investment vehicle, fund flows continued to be driven by ETF products. Cathay Global Auto & Electric Vehicles ETF 00893, a thematic portfolio that capitalizes on new modes of mobility, gathered the most inflows this month, amounting to TWD 6.6 billion. The largest fund in Taiwan, Yuanta/P-shares Taiwan Top 50 ETF 0050, lost TWD 4.4 billion in assets.

Exhibit 5 Top and Bottom Funds by July Net Flow

* Since the funds began between January and July 2021, their performance data denotes since-inception return. Cathay Global Auto & Electric Vehicles ETF started on 6/21/2021, CTBC Hang Seng China High Div Yield ETF on 1/27/2021, and Fubon FTSE Vietnam ETF on 3/30/2021.

©2021 Morningstar. All rights reserved. The information, data, analyses and opinions presented herein do not constitute investment advice; are provided as of the date written, solely for informational purposes; and subject to change at any time without notice. This content is not an offer to buy or sell any particular security and is not warranted to be correct, complete or accurate. Past performance is not a guarantee of future results. The Morningstar name and logo are registered marks of Morningstar, Inc. This article includes proprietary materials of Morningstar; reproduction, transcription or other use, by any means, in whole or in part, without prior, written consent of Morningstar is prohibited. This article is intended for general circulation, and does not take into account the specific investment objectives, financial situation or particular needs of any particular person. Investors should consult a financial adviser regarding the suitability of any investment product, taking into account their specific investment objectives, financial situation or particular needs, before making any investment decisions. Morningstar Investment Management Asia Limited is licensed and regulated by the Hong Kong Securities and Futures Commission to provide investment research and investment advisory services to professional investors only. Morningstar Investment Adviser Singapore Pte. Limited is licensed by the Monetary Authority of Singapore to provide financial advisory services in Singapore. Either Morningstar Investment Management Asia Limited or Morningstar Investment Adviser Singapore Pte. Limited will be the entity responsible for the creation and distribution of the research services described in this article.

:quality(80)/cloudfront-us-east-1.images.arcpublishing.com/morningstar/5FNGF7SFGFDQVFDUMZJPITL2LM.png)

:quality(80)/cloudfront-us-east-1.images.arcpublishing.com/morningstar/EOGIPTUNFNBS3HYL7IIABFUB5Q.png)

.jpg)