A slew of recent fund launches, branded with ESG (environmental, social and governance) investment strategies, have caught the attention of Asian regulators, especially in Hong Kong and Singapore. The regulators want to ensure that there’s no ‘greenwashing’, a process in which a company markets itself as environmentally sound, or claims to adhere to ESG factors, while not actually doing so. Several areas are now in focus, including the lack of common standards and definitions, the resultant comparability issues, and disclosures.

The Securities and Futures Commission of Hong Kong established a steering group for green finance development. With an aim to mitigate disclosure and comparability issues, the watchdog compiles a list of funds with ‘green’ or ‘ESG’ investment objectives that meet globally recognized green or ESG criteria or principles, such as the United Nations Sustainable Development Goals. Similarly, in Singapore, the regulator has stepped up research into technical areas of climate and relevant rating capabilities. An environmental risk management framework is also available for asset managers to reference.

Mapping Fund Exposure to Risks

Investors can now calibrate the ESG risks involved in their investments, and evaluate non-financial impacts a fund manager could bring about with stock picks.

The previous article showed how one can gauge ESG risk exposure in individual stocks with Sustainalytics risk scoring. Today, we look at funds for sale in Hong Kong and Singapore, and use Morningstar Sustainability Ratings to understand the exposure their stock picks have to issues such as fossil fuel exposure, or unethical business practices.

Some funds take a rigorous, in-depth approach to integrating ESG factors in their investment strategies. Others may be labeled ESG, or sustainable, but do very little to mitigate investors’ exposure to companies with unattractive ESG risk profiles.

If a fund describes itself as an ESG fund in its prospectus and marketing materials, it is reasonable to expect the portfolio to favor companies with leading environmental, social, and governance practices. You would expect--at the very least--that the fund would not expose an investor to more ESG risk than a traditional (non-ESG) fund in the same category.

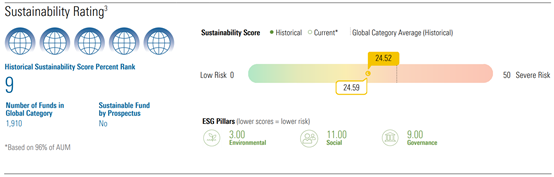

The Morningstar Sustainability Rating is a quick way to measure ESG risk in a fund portfolio. The rating starts with each company’s Sustainalytics ESG Risk Rating, which measures the degree to which individual companies in the portfolio face financial risks from ESG issues. Those individual scores are asset-weighted and rolled up into an overall, portfolio-level rating. The rating is easy to interpret: 5 globes means the overall portfolio has negligible ESG risk; 1 globe means it is exposed to significant ESG risk.

Here’s what the Sustainability Rating looks like for UBS (Lux) Equity Fund China Opportunity with US$15 billion under management.

- source: Morningstar Direct

Managed by Bin Shi, the Fund's Sustainability Score reveals that its portfolio exposes investors to less unmanaged ESG risk than 90% of peers in the Morningstar China Equity Category. Although the fund is not mandated by its prospectus to follow sustainable investing principles, the fund’s sustainability ratings are accessible on Morningstar Direct. Specifically, in this UBS fund, the social and governance concerns of its equity holdings are mostly related to business ethics, customer and employee relations.

Another metric that fund investors can use to evaluate mutual fund portfolios' ESG risk exposure is the Morningstar Low Carbon Designation.

This designation, developed with Sustainalytics, evaluates how well companies in the portfolio are managing their exposure to climate risk by limiting low carbon transition risks, and exposure to fossil fuels. It rolls the company risk scores up into a portfolio-level score.

While more funds appear to be avoiding fossil fuels, investors should not assume that all sustainable funds do. It's also possible that a portfolio earns a Low Carbon designation but has above-average exposure to ESG risk in the portfolio otherwise.

In fact, funds with a 5 Globe Rating (a portfolio of negligible ESG risks) are offered with a variety of investment strategies, and not all of them are mandated by prospectus to follow ESG principles. Below is a list of funds that are scored with both a 5-Globe Sustainability Rating and an Analyst rating of Bronze or better.

- source: Morningstar Direct

* denotes the funds are available for sale in both Hong Kong and Singapore, Hong Kong only otherwise.

©2021 Morningstar. All rights reserved. The information, data, analyses and opinions presented herein do not constitute investment advice; are provided as of the date written, solely for informational purposes; and subject to change at any time without notice. This content is not an offer to buy or sell any particular security and is not warranted to be correct, complete or accurate. Past performance is not a guarantee of future results. The Morningstar name and logo are registered marks of Morningstar, Inc. This article includes proprietary materials of Morningstar; reproduction, transcription or other use, by any means, in whole or in part, without prior, written consent of Morningstar is prohibited. This article is intended for general circulation, and does not take into account the specific investment objectives, financial situation or particular needs of any particular person. Investors should consult a financial adviser regarding the suitability of any investment product, taking into account their specific investment objectives, financial situation or particular needs, before making any investment decisions. Morningstar Investment Management Asia Limited is licensed and regulated by the Hong Kong Securities and Futures Commission to provide investment research and investment advisory services to professional investors only. Morningstar Investment Adviser Singapore Pte. Limited is licensed by the Monetary Authority of Singapore to provide financial advisory services in Singapore. Either Morningstar Investment Management Asia Limited or Morningstar Investment Adviser Singapore Pte. Limited will be the entity responsible for the creation and distribution of the research services described in this article.

:quality(80)/cloudfront-us-east-1.images.arcpublishing.com/morningstar/5FNGF7SFGFDQVFDUMZJPITL2LM.png)

:quality(80)/cloudfront-us-east-1.images.arcpublishing.com/morningstar/EOGIPTUNFNBS3HYL7IIABFUB5Q.png)

.jpg)