Coronavirus has hit many emerging market countries hard, but China has bounced back relatively quickly but others such as Brazil are still fighting to keep cases down. As a result, the economic impact – and stock market performance – across the emerging markets has become very polarised.

As Janus Henderson portfolio manager Jennifer James says, EM countries are “in the same storm but not in the same boat”. How have the biggest emerging markets performed this year, and what do fund managers expect in 2021 as the world braces for a vaccine – and a new US President?

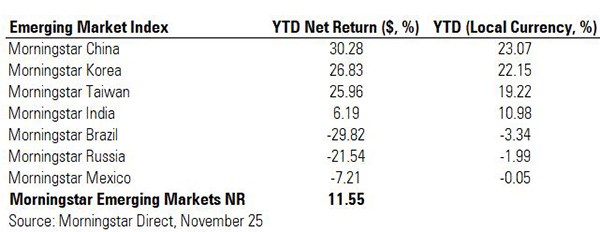

We’ve recently written about China’s prospects, as well as how a Biden Presidency means a change of tack on US-China relations. We’ve looked at some of the biggest countries in the MSCI EM Index, apart from China. (To make comparisons easier, we’ve used US dollars for return figures, but also includes returns in local currencies: in the case of Brazil and Russia, for example, it makes a big difference).

North Asia Outperforms South Asia

South Korea and Taiwan, with its close geographic and political links to China, have been the best performers of our emerging market cohort, with rises of around 26% in the year to date.

Our recent stock of the week recently featured Taiwan Semiconductor, which has a whopping 30% weighting in the Morningstar Taiwan index and is also a staple in many active EM fund portfolios. Taiwan Semiconductor is the biggest holding in the Neutral-rated investment trust Templeton Emerging Markets (TEMIT) (as of October 31, 2020), just ahead of Chinese tech behemoth Tencent (00700). Co-manager Chetan Sehgal likes Taiwanese companies in general because they have a recent track record of increasing dividends. He’s also a fan South Korean companies because they’re improving their corporate governance.

India has lagged Asia-Pacific this year: it’s just gone into recession for the first time in its history, has been hard hit by coronavirus and asset manager JP Morgan has just downgraded its growth forecast from 7% to 6.5%. “After an extensive period of very rapid growth, India has slowed in the past few years. Its structural reform process has also lost momentum, leaving the economy less open and flexible today than we expected.”

On a longer term view, the country’s prospects look brighter, the company says: “Yet even with our downgrade, India’s growth forecast leads all emerging economies by a wide margin, reflecting its ample room for convergence, its young and growing population, and the rapidly improving education and skill level of its human capital.”

Emerging Europe and Latin America

Russia’s prospects divide opinion among asset managers, especially as the country’s economy, as a large oil exporter, has been flattened by this year’s slump in oil prices. The Morningstar Russia index is the second worst performing emerging market this year with a loss of more than 20%.

Daniel Grana, an emerging markets portfolio manager at Janus Henderson, says the corporate sector in Russia is strong and well capitalised, particularly the banks. “From a risk point of view, Russia is very attractive,” he says. But the country has been slow to react to the transition to low carbon in a year when oil demand from airlines and cars has fallen off a cliff. “The authorities have done very little to prepare for peak oil,” he adds.

JP Morgan flags Russia as one of the countries most exposed by the transition to a low carbon world, and estimates that the shift away from oil could reduce Russian’s economic growth by a substantial 6.5% over the next 30-40 years.

Brazil is also one of the countries most exposed to changing ESG trends, according to JP Morgan. This year it’s been the worst performing of the Morningstar EM country indices, with a drop of nearly 30% in US dollar terms (just -3% in local currency, which shows how much the Brazilian real has fallen) and with one of the highest Covid-19 death rates in the world. But economic growth is expected to return in 2021, helped by a rebound in commodity prices. A Biden Presidency is likely to improve political co-operation, says Gary Greenberg, head of global EM at Federated Hermes, and that is likely to help Mexico too.

Recovery Hopes

Greenberg says North Asian countries, having shown resilience in dealing with the coronavirus, should continue to prosper, but the recovery should be broader-based next year across emerging markets. He expects natural resources-focused countries like Mexico and Russia to do well as the world economy starts to re-open and demand for energy increases. EM stocks are cheaper than developed ones too in terms of long-term trends, he says. Pictet’s EM portfolio manager Avo Ora says that a weaker US dollar could also help emerging market performance in 2021 after a bruising year for EM currenices in 2020. After such a disruptive year for the world economy, an 11% gain for the EM index is a pretty credible performance, but China remains key to beating this figure in 2021.

:quality(80)/cloudfront-us-east-1.images.arcpublishing.com/morningstar/5FNGF7SFGFDQVFDUMZJPITL2LM.png)

:quality(80)/cloudfront-us-east-1.images.arcpublishing.com/morningstar/EOGIPTUNFNBS3HYL7IIABFUB5Q.png)