In part 1, we discussed the difficulties in beating the market and started looking at ways to shape a portfolio.

To safeguard against these risks of high dividend yields tend to be a sign of trouble, it’s best to stick to broadly diversified dividend funds, where a few bad apples won’t significantly affect the portfolio. An example is the Vanguard High Dividend Yield ETF (VYM, U.S.-listed). This fund sweeps in stocks representing the higher-yielding half of the U.S. dividend-paying market.

It’s also effective to select funds that screen for both quality and yield, like Schwab U.S. Dividend Equity ETF (SCHD, U.S.-listed). This fund has a more compact portfolio than VYM, but it keeps risk in check by screening for stocks with high return on equity, dividend growth, strong cash flow/debt, and high yields. Both funds further mitigate risk by weighting their holdings by market cap, which causes stocks with weakening fundamentals to become a smaller part of these portfolios as their prices decline.

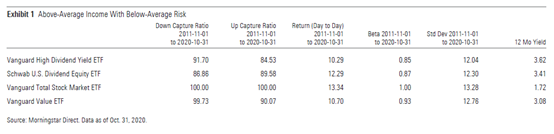

Both approaches have been effective at boosting yield without increasing risk. The two funds exhibited lower volatility than the broad U.S. stock market and tended to hold up better during market downturns, as shown in Exhibit 1. While they lagged the market over the trailing nine years through October 2020, this largely owed to their value tilts.

It’s harder to pick up yield without picking risk in the bond market. Sticking to investment-grade bonds is an easy way to keep risk in check, though it also limits yield. For those who must venture into high-yield bonds, it’s prudent to stick to some of the lower-risk options, like Vanguard High-Yield Corporate (VWEHX, U.S.-listed). This actively managed fund favors bonds at the higher-rated end of the high-yield universe and is cheaper than most index funds in the high-yield Morningstar Category.

While these aren’t the highest-yielding options available, they will probably offer a better risk/reward trade-off than their higher-yielding counterparts. Those who need more income than these funds provide can always sell a small part of their portfolio each year to supplement the income distributions. For example, selling up to 2% of a portfolio each year should be sustainable, as that is close to the Federal Reserve’s target inflation rate. So, the portfolio would need only to keep pace with inflation to preserve its value.

Nontraditional Income Alternatives

Outside the traditional stock and bond categories, there are some strategies that offer enticing yields, but most aren’t worth it. For example, master limited partnerships aren’t included in stock or bond indexes. Most of these entities process and transport energy commodities. They are required to distribute at least 90% of their income to investors.

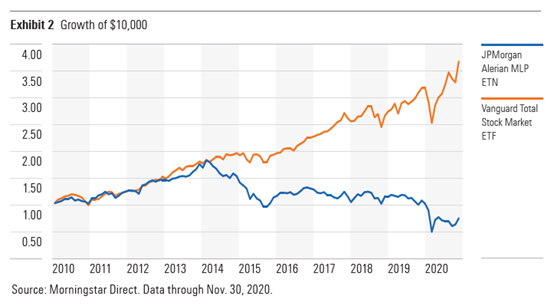

Yet, despite their high yields, MLPs have delivered subpar total returns over the past decade, as shown in Exhibit 2. This is largely because their performance is linked to demand for fossil fuels, which appears to be facing a secular decline.

Preferred stocks also fall outside of traditional stock and bond indexes and carry juicy yields. But they also carry considerable sector concentration risk, as financial-services firms account for most of this market. Preferred stocks carry greater nonpayment credit risk than most bonds, as they are not legally obligated to honor their promised dividends. Yet upside potential is also limited because most of these securities can be called slightly above par. These have lagged VYM over the past decade.

To some, rental property may be a decent alternative to generate income. It’s great if you get a good tenant and nothing breaks, especially because there are many potential tax deductions to offset the rental income. But a lot can go wrong. Each property often ties up a lot of wealth, which can hurt diversification. And of course, bad tenants and large maintenance expenses can quickly cause a property to become more trouble than it’s worth.

For most, it’s best to keep income investment strategies simple and focus on risk before yield.

Get the Basics Right

You don’t need to have any special insights to be a successful investor. All that is required is to save, be patient, stick with your plan, keep fees low, and diversify. The path to success isn’t hard to identify, but it is hard to walk.

One of the great ironies of building wealth is that you have to care enough about money to save it, but you can’t be afraid to lose it. At some point, you will lose. But it’s that willingness to take risk that the market rewards over the long term. Stay diversified, stay disciplined, and let the market work for you. That’s as close to a winning formula as there is.

:quality(80)/cloudfront-us-east-1.images.arcpublishing.com/morningstar/5FNGF7SFGFDQVFDUMZJPITL2LM.png)

:quality(80)/cloudfront-us-east-1.images.arcpublishing.com/morningstar/EOGIPTUNFNBS3HYL7IIABFUB5Q.png)