Editor's note: Read the latest on how the coronavirus is rattling the markets and what you can do to navigate it.

These are scary times. Even though the market has partially recovered from the sharp sell-off in late February and March 2020, there is still considerable uncertainty about the economic fallout from the novel coronavirus. It's unclear how long the pandemic and social distancing measures will last, how much unemployment will rise, or how much it will hurt business. That uncertainty is a big part of why the market has sold off and why it's especially risky to double down on stocks now.

The risks are real, but it's important to keep calm and stay focused on the long term. Making big changes to a portfolio out of fear often does more harm than good. For most, the best course of action is to stick to your long-term investment plan.

But sticking to a long-term plan isn't the same as doing nothing. This is a good time to revisit high-fee and tax-inefficient mutual funds that you held on to. It may also be necessary to rebalance into beaten-down assets, like stocks, to bring your portfolio in line with its target allocation. That said, it probably isn't prudent to overweight stocks until things have calmed down a bit.

Don't buy the dip

While many fight the urge to sell, the more intrepid among us may be tempted to load up on stocks after a large market pullback, and trim back as the market runs up. This seems consistent with the most fundamental of all investment principles: Buy low and sell high.

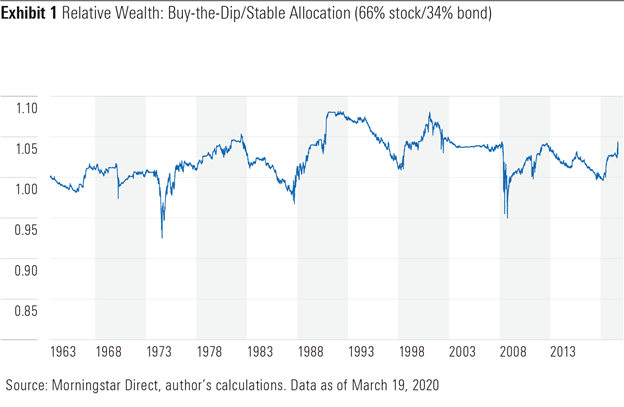

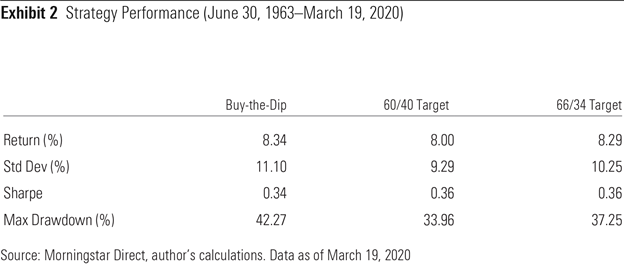

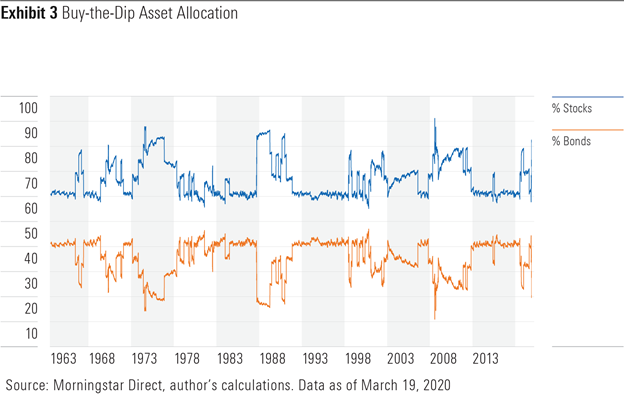

However, it turns out that buying the dips isn't an effective strategy over the long term. To test this, I devised a "buy-the-dip" strategy that starts with a 60/40 allocation to U.S. stocks and Treasury bills. For every 10% decline in the value of the U.S. market from the most recent high, the portfolio would increase its allocation to stocks by 10 percentage points. For every 10% increase from the most recent low, it would trim its allocation to stocks by 10 percentage points, though it wouldn't take the stock allocation below 60%. Exhibits 1 and 2 show how this strategy performed. Exhibit 3 shows its asset allocation over time.

This strategy posted slightly higher returns than a passive 60/40 stock/bond portfolio rebalanced to its target allocation annually, as Exhibit 3 shows. However, that's not a fair comparison because the buy-the-dip strategy had a higher average stock allocation (66%) over its life. Its return was almost identical to what investors would have earned if they started with a 66/34 stock/bond allocation and rebalanced annually. That said, buying the dip was riskier than the 66/34 target allocation. It exhibited slightly higher volatility and a larger maximum drawdown.

This elevated risk isn't surprising. Volatility tends to increase during market downturns. Market declines are also usually indicative of deteriorating business conditions. Increasing stock allocations during these times increases exposure to these risks.

The real question is why this strategy didn't earn greater compensation for assuming more risk than the static allocation. As risk rises during bad times, valuations tend to fall. All else equal, that should lead to higher returns. However, valuations alone don't tell the full story. There is an opposing force at work that this strategy bets against: momentum.

In the short term, performance tends to persist. Recent market losses are often followed by more losses, while recent gains often portend more to come. These trends may emerge because investors can be slow to react to new information, causing prices to adjust more slowly than they should. Bad news often clusters, and investors may not fully appreciate the potential impact of each piece of information. For example, weak consumer confidence tends to lead to weak spending and corporate profits, which can lead to higher unemployment, an increase in bankruptcies, and tighter lending, perpetuating the cycle. This process can also work in reverse.

Additionally, investors' comfort with risk is procyclical, creating a knock-on effect that further contributes to performance trends. Investors are willing to accept higher valuations when risk seems low, but when risk picks up, lower valuations are usually required to find a willing buyer.

The buy-the-dip strategy has intuitive appeal, but it doesn't work well because it is an anti-momentum strategy. It doubles down on stocks while conditions are deteriorating and trims them while things are improving. While it doesn't appear to hurt performance much either (when done in moderation), it's probably better to stick to a long-term strategic asset allocation that aligns with your risk tolerance. Buying the dips probably won't help boost returns. But using momentum to your advantage with trend-following could help reduce risk.

Trend-Following

Trend-following is a market-timing strategy that, in many ways, flips buy-the-dip on its head. It owns risky assets, like stocks, when they have recently offered positive returns, otherwise it moves to short-term, low-risk assets. There are a few important caveats: 1) Trend-following can lag the market for years because it tends to miss out on the early part of a recovery. 3) This strategy doesn't work as well when high volatility prevents a clear trend from forming.

Other Strategies to Cut Risk

There are good alternatives for those looking for a more hands-off approach to cut risk. The simplest and most effective approach is to shift to a more-conservative asset allocation. Market downturns naturally give most investors more-conservative asset allocations, as stocks tend to underperform bonds during those times.

Even if a more-conservative allocation than the market has given you is appropriate, it may feel dumb to trim back on stocks when they're trading at a discount to where they once were. However, risk tolerance should be the primary driver of asset-allocation decisions. If you need the money soon or are at risk of panicking if things get worse, it's probably prudent to realize some losses and reposition.

Stick to the Plan

Whatever investment plan you craft, it's important to stick with it and avoid making big changes out of fear or greed. That often means sticking to your long-term strategic asset allocation, regardless of what's going on in the market, and populating it with low-cost, broadly diversified funds. That's easy to understand but can be hard to do. Checking in on your portfolio less frequently and keeping the plan simple can help. With investing, less is usually more.

A version of this article previously appeared in the April 2020 issue of Morningstar ETFInvestor.

:quality(80)/cloudfront-us-east-1.images.arcpublishing.com/morningstar/5FNGF7SFGFDQVFDUMZJPITL2LM.png)

:quality(80)/cloudfront-us-east-1.images.arcpublishing.com/morningstar/EOGIPTUNFNBS3HYL7IIABFUB5Q.png)