As coronavirus made its way westward in recent weeks, the virus has caused one of the worst market downturns since the Global Financial Crisis more than a decade ago. Economic growth has come under serious threat as global supply chains have ground to a halt and the outlook for business deteriorates.

With many new launches over the past few years, funds with sustainable or ESG mandates have provided an attractive opportunity for investors looking to gain exposure to companies better aligned with their sustainability preferences and values. But as most of these strategies have relatively short and unscarred track records, they haven’t been tested during market corrections before. The recent spate of market turbulence has created an opportunity for many of these funds to be truly tested on their merits.

Here, we look at the performance passive exchange-traded funds in the third week of February – the week that marked the beginning of the major falls on developed stock markets. We compared rolling monthly returns up to March 20 of sustainable or ESG ETFs available in four popular Morningstar categories with the returns of low-cost non-ESG ETFs to see how each fared.

The results show that passive sustainable and ESG funds have weathered the market downturn better than conventional ETFs in three of the four investment categories we examined: Global, Europe, and US Large-Cap. The Emerging Markets Large-Cap category had the lowest proportion of outperforming ESG funds at just under 30%.

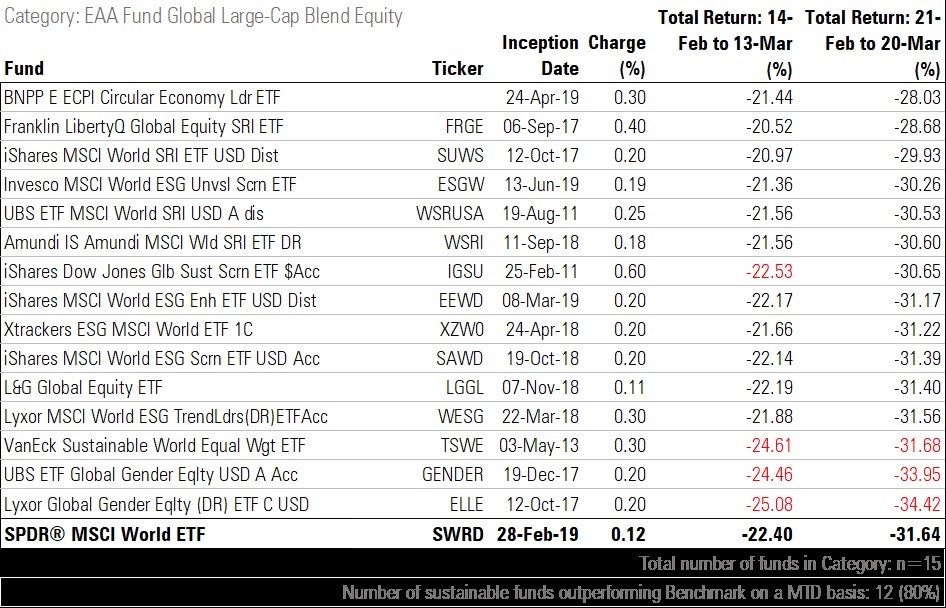

Global Large-Cap Blend Equity

Of the 15 sustainable ETFs in the global large-cap blend category, 12 (or 80%) outperformed the SPDR MSCI World ETF in the month to March 20. This is an improvement from the previous rolling month, suggesting these tracker funds have provided good downside protection as markets continue to struggle.

To explain this, it’s important to remember how ESG and sustainable investing creates natural biases away from companies deemed as high-risk on various measures. For strong performers in the global equity category, the result of this has been a bias to companies with robust underlying earnings and lower relative price volatility than the benchmark.

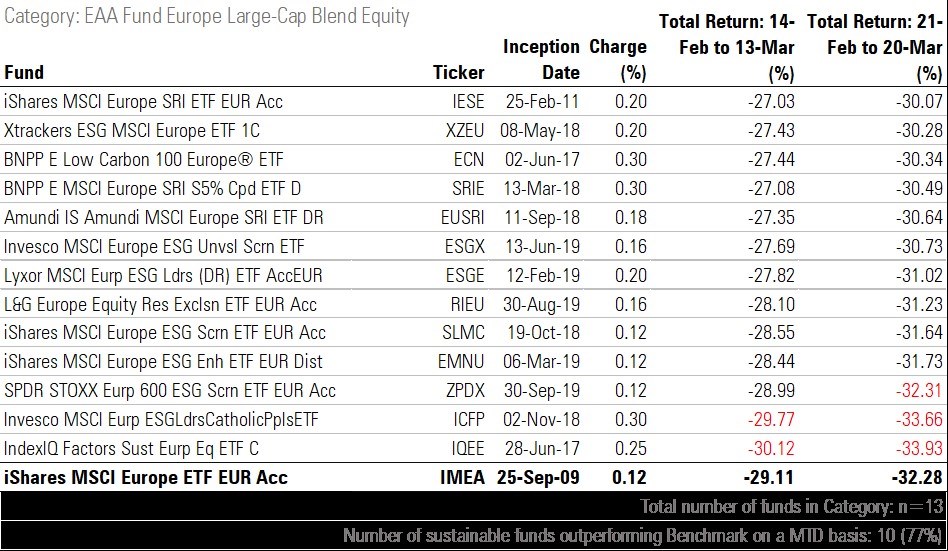

Europe Large-Cap Blend Equity

The Europe large-cap equity category has shown strong overall performance, with 10 of the 13 (77%) passive sustainable funds outperforming the iShares MSCI Europe ETF. Much like the global category, winners in the European category have reaped the benefits of having portfolios invested in higher quality companies whose underlying fundamentals have supported performance. One example of this has been a relative underweight to energy stocks, which have faced a particularly tough time over the last few weeks.

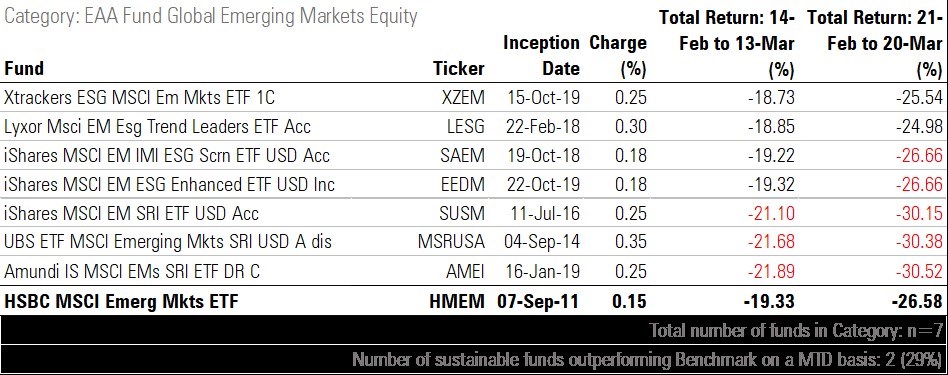

Global Emerging Markets Equity

Of the 7 passive ETFs in the global emerging markets equity category, fewer than half (29%) beat the HSBC MSCI Emerging Markets ETF in the month. Some of the worst performances can be partly explained by funds’ lower exposure to Chinese stocks, which tend to score lower on ESG metrics. As the country the coronavirus first emerged, China fell early but recovered some lost ground while shares in other regions tumbled.

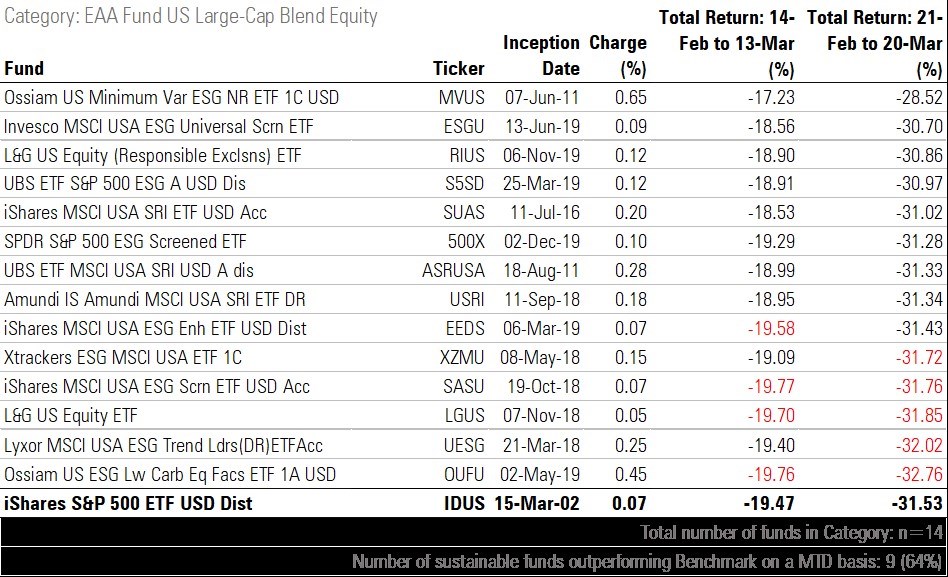

US Large-Cap Blend Equity

9 of the 14 US large-cap sustainable funds (64%) beat the iShares S&P 500 ETF. Relative performance here has been driven in part by underweights to typical high-risk ESG sectors such as energy, the upshot of which has been low volatility. When looking at price multiples, there is also some evidence of ESG funds carrying lower valuations in their portfolios. This is a positive, as companies trading at unjustifiably high valuations normally have some of the steepest sell-offs during market downturns.

Further analysis shows that ESG and sustainable funds portfolios tend to hold more stocks that rank highly on factors which indicate quality and a business with fundamental strength. In Morningstar terms, this could be companies with a strong economic moat, which presents a barrier to competition. Stocks in these funds tend to have strong competitive advantages and healthy levels of debt, meaning they should hold up better during a downturn. Passive sustainable funds are showing they can hold their own versus their conventional peers.

:quality(80)/cloudfront-us-east-1.images.arcpublishing.com/morningstar/5FNGF7SFGFDQVFDUMZJPITL2LM.png)

:quality(80)/cloudfront-us-east-1.images.arcpublishing.com/morningstar/EOGIPTUNFNBS3HYL7IIABFUB5Q.png)