In part 1 of this article, we looked at the global landscape of thematic fund. In part 2, we continue with a brief look in Asia and share best practices for choosing from this expansive universe.

Japan

Japan is the largest thematic fund market outside of Europe and North America. More than 95% of assets in Japan-domiciled thematic funds is invested in Technology themes. Funds tracking Robotics and Automation, Connectivity, and Artificial Intelligence themes are particularly popular.

Since the beginning of 2018, 42 new thematic funds have hit the Japanese market. Almost nine out of 10 launches since the beginning of 2017 have been technology focused.

The dominant player in the Japanese thematic market is Nikko Asset Management. Within the firm’s range of thematic offerings, the Robotics and Fintech funds are the largest by size.

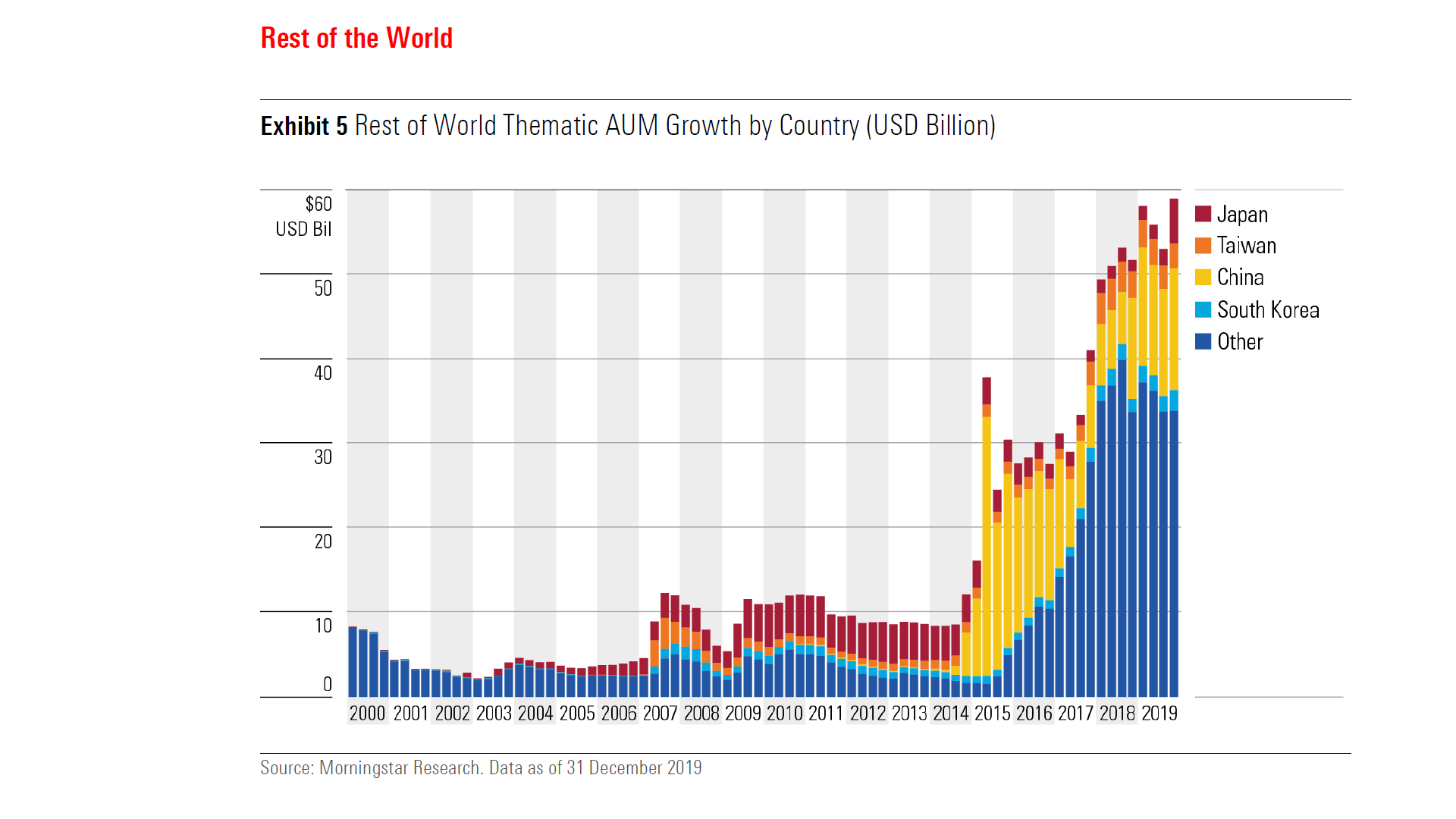

China

Over the past decade China has risen from nothing to become the second-largest thematic fund market in Asia with assets of US$14 billion.

Political themes are the most popular among Chinese investors, as funds in this group held over US$6 billion in assets at the end of 2019. Most of these assets sit in Chinese Structural Reform funds, which aim to allow investors to profit from the privatization of Chinese state-owned enterprises.

South Korea

Trailing behind in terms of size, but also growing fast, is the South Korean thematic fund market. Consumer themes focused on capturing the growth of the middle class in Asia have proven popular amongst Korean investors.

A Trifecta Bet

Investors in thematic funds are making a trifecta bet (a term from the racetrack). Specifically, they are implicitly betting that they are:

1. Picking a winning theme.

2. Selecting a fund that is well-placed to harness that theme.

3. Making their wager when valuations show that the market hasn't already priced in the theme's potential. The odds of winning these bets are low, but the payouts can be meaningful.

The long-term performance figures for thematic funds are not flattering. They suggest that investors' odds of selecting a fund that will survive and outperform over the long run are slim.

Fitting Thematic Funds Into Your Portfolio

Because of their narrow exposure and higher risk profile, thematic funds are best used to complement rather than replace existing core holdings. Some might be considered as part of a core allocation, as they are broadly diversified and retain some of the characteristics of a broad global benchmark. More-narrow exposures might also be considered as single-stock substitutes for those investors looking to express a view on a theme but who lack the time, tools, and inclination to conduct due diligence on individual companies.

Durable themes are expected to play out over many years. This means that they are best deployed over longer investment horizons.

Return Booster or Risk Reducer?

Most thematic funds will be used with the hope of boosting returns over the investment period, but some can be specifically used to reduce portfolio risk. For example, alternative energy funds can be substituted for core energy holdings to reduce carbon risk.

Even if we set aside the claims of prospective outperformance from asset managers, if a thematic fund has drivers of risk and return that are distinct from other portfolio holdings, adding them around the margins of a core portfolio might yield diversification benefits.

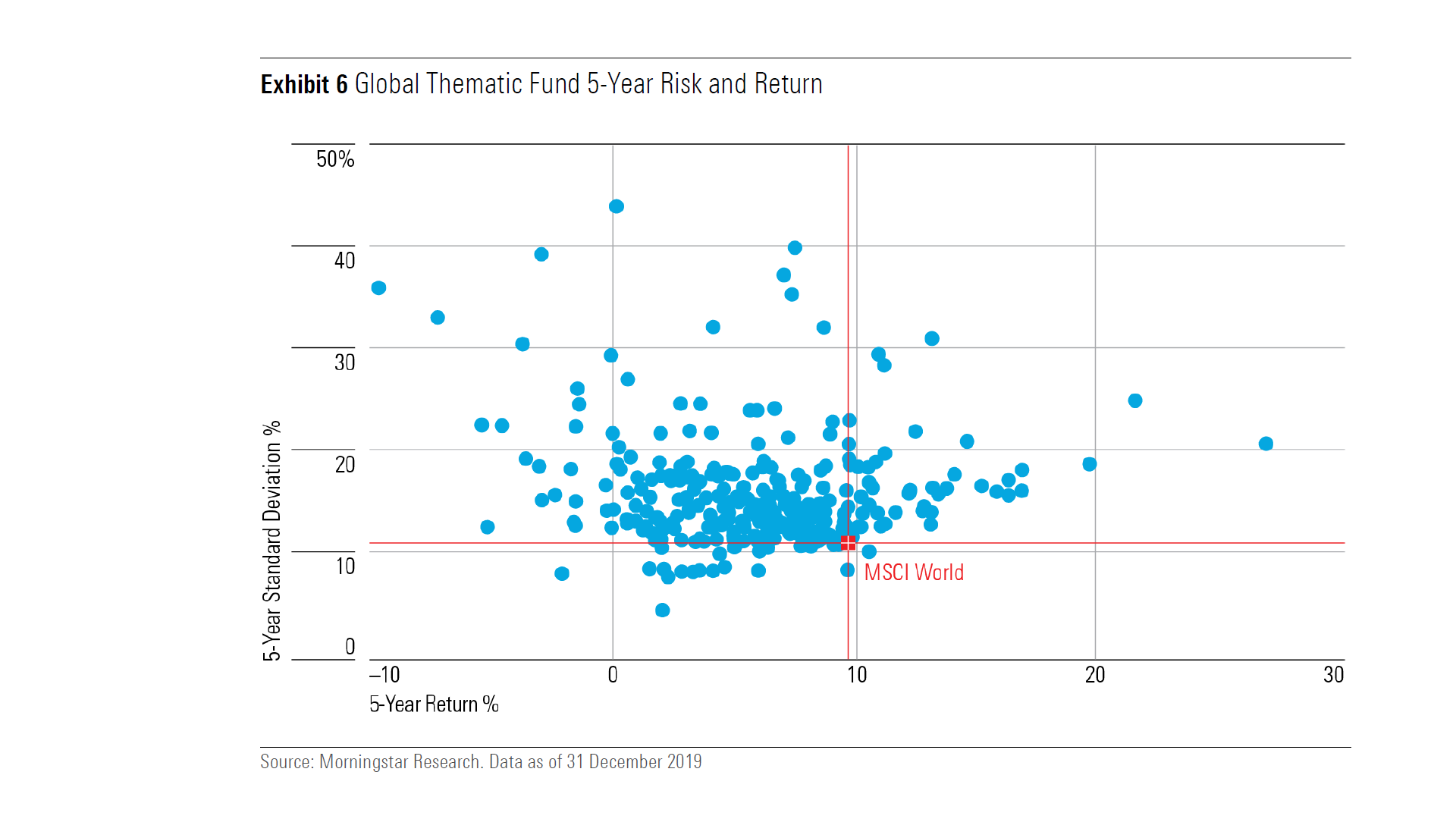

The exhibit below shows the distribution of five-year returns and standard deviations for all the surviving thematic funds we examined globally. The MSCI World Index is represented by the red spot. Clearly, the majority of these funds have failed to either boost returns or reduce risk relative to the cap-weighted global equity benchmark.

Full report “Global Thematic Funds Landscape” can be found here.

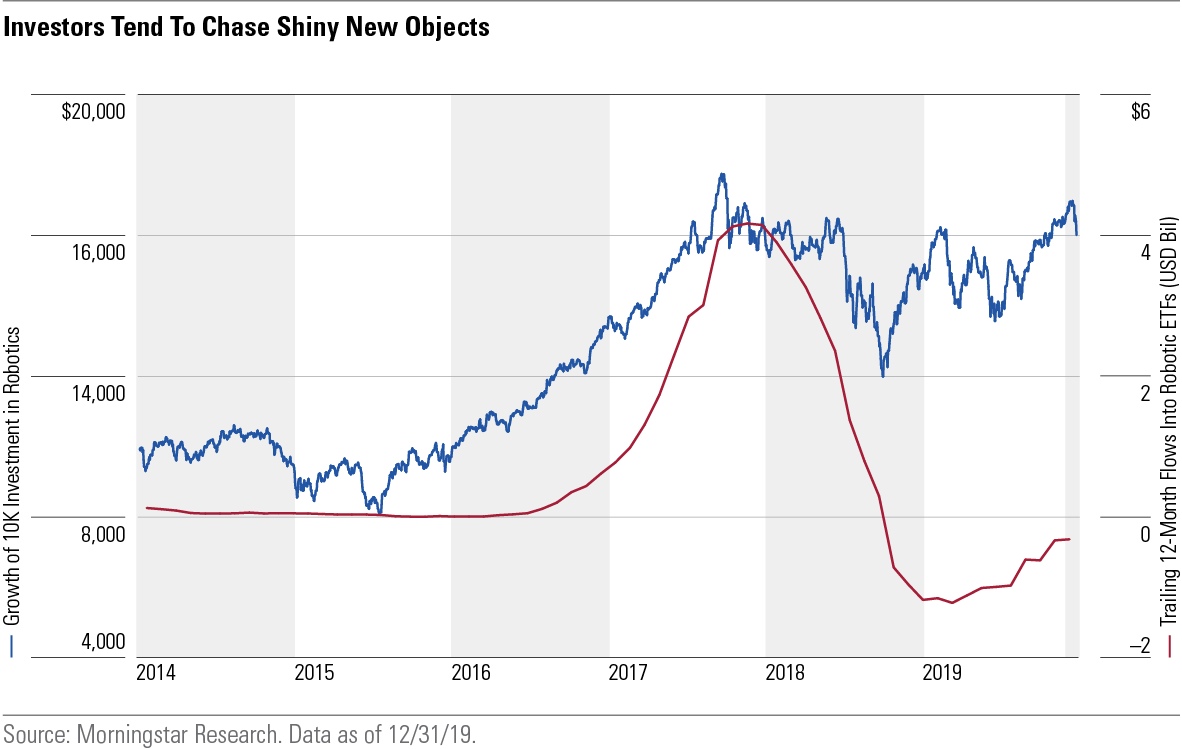

Chasing Shiny Objects

Thematic funds have captured investors’ imagination, but buyers should beware. Oftentimes, these funds are designed more with salability in mind than investment suitability. Many cross the border into gimmick territory. Examples abound. The Whiskey ETF, The Kids Fund, and StockJungle.com Pure Play Internet Fund are just a few examples of those that have come and gone over the years. Investors have often piled into these funds at precisely the wrong time (The final exhibit features a recent example), only to be disappointed. Investors mulling thematic ETFs should think long and hard about whether a theme has durable investment merit or if it is a mirage.

:quality(80)/cloudfront-us-east-1.images.arcpublishing.com/morningstar/5FNGF7SFGFDQVFDUMZJPITL2LM.png)

:quality(80)/cloudfront-us-east-1.images.arcpublishing.com/morningstar/EOGIPTUNFNBS3HYL7IIABFUB5Q.png)