Sustainable investing can be a difficult concept to get your arms around.

First of all, there are a lot of terms that seem synonymous--or are used interchangeably, depending who you talk to--including sustainability, ESG (short for environmental, social, and governance), impact investing, and responsible investing.

There are also some very pervasive myths. Many people believe they will sacrifice return if they invest in line with their beliefs, so they figure they should hold their nose and stick with conventional investments. Not true!

If confusion is the biggest thing holding you back from recognizing sustainable investments, read on. We’ll guide you through how we classify sustainable funds and show you how to use Morningstar research to distinguish and evaluate sustainable investments on your own.

First ... the Terms

Let’s start with the big one:sustainable investing. At Morningstar, we frame sustainable investing as an overarching investment approach that incorporates environmental, social, and corporate governance criteria throughout the investment process.

Environmental factors include company behavior and policies on issues like climate, pollution, energy efficiency, and renewable energy. The social factor evaluates things like a company’s commitment to inclusion and diversity in the workplace, fair wages, forced labor, supporting the local community, customer privacy, and product safety. Finally, the governance factor measures things like executive pay, political donations and lobbying, bribery and corruption, and board-level attention to sustainability and climate issues.

Let’s pause here for some mythbusting. Raise your hand if you think the crux of sustainable investing involves avoiding “problem” stocks, such as tobacco or gun companies.

This method, called negative (or exclusionary) screening, used to be standard among socially responsible funds, which were an early version of sustainable funds that were around in the 1980s and 1990s (but you still hear the term today). Though negative screening is still used today, especially among funds that invest in line with religious values, a problem with using the approach exclusively is that it excludes prominent companies from the investment universe for nonfinancial reasons, which can lead to underperformance.

These days, many sustainable funds take a more integrative approach to building a portfolio. The emphasis is on identifying stocks that have best-in-class practices when it comes to addressing ESG issues relevant to that particular company. It tilts the portfolio toward companies that are better at managing ESG issues and therefore less likely to face financial risks such as fines, lawsuits, and reputational damage.

Types of Sustainable Funds

Before we delve into how we classify sustainable funds, let’s go over what a prospectus is. Every mutual fund and exchange-traded fund is required by the Securities and Exchange Commission to publish a guide that explains (among other things) its investment strategy, who runs the fund, how much it costs, and what its major risks are.

An increasing number of funds state in their prospectus that they consider ESG factors as part of their investment process. Beyond stating that ESG factors are considerations, however, these funds typically don’t use exclusionary screens, impact analysis, or shareholder engagement as a formal part of their process. We call these funds ESG Consideration funds.

ESG Focus funds, by contrast, are funds that make sustainability factors a featured component of their processes for both security selection and portfolio construction.

A third group, Impact funds, focuses on broad sustainability themes and on delivering social or environmental impact alongside financial returns. Impact funds are often focused on specific themes, such as low carbon, gender equity, or green bonds (which fund new and existing projects with environmental benefits).

Finally, there are Sustainable Sectorfunds, which focus on the stocks of companies that contribute to, and aim to benefit from, the transition to a green economy in areas like renewables, energy efficiency, environmental services, water, and green real estate.

This article shows how the landscape of sustainable funds breaks down into the four types and lists prominent funds in each category.

Putting Your Knowledge of Sustainable Funds to Work

Unfortunately for investors, there aren’t consistent naming conventions among sustainable funds. Most funds that emphasize the consideration of ESG factors into their process are marketed as sustainable offerings and include key terms like ESG or sustainable in their names.

Let’s say you are interested in buying XYZ Select ESG Fund. According to the fund’s prospectus and its description on the fund company’s website, XYZ Select ESG is an actively managed fund that seeks companies with healthy balance sheets, good growth prospects, and leading environmental, social, and governance practices.

The next step in your consideration process should be to analyze how well the fund is actually delivering on these promises. Here’s how our ratings can help you can do it.

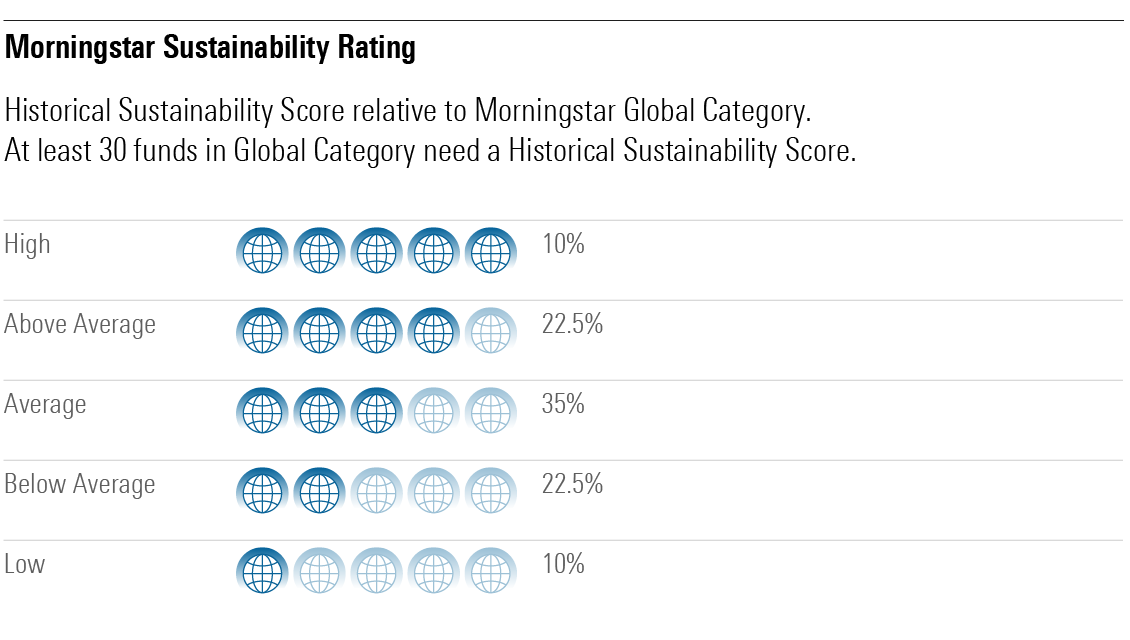

Our enhanced Morningstar Sustainability Rating (developed with Sustainalytics, a leading provider of ESG research) measures a fund portfolio’s aggregate exposure to ESG risks. The rating works like this: First, it measures the degree to which individual companies in the portfolio face financial risks from ESG issues, then it rolls those individual scores up into an overall, portfolio-level score. The rating is easy to interpret: 5 globes means the overall portfolio has negligible ESG risk; 1 globe means it is exposed to significant ESG risk.

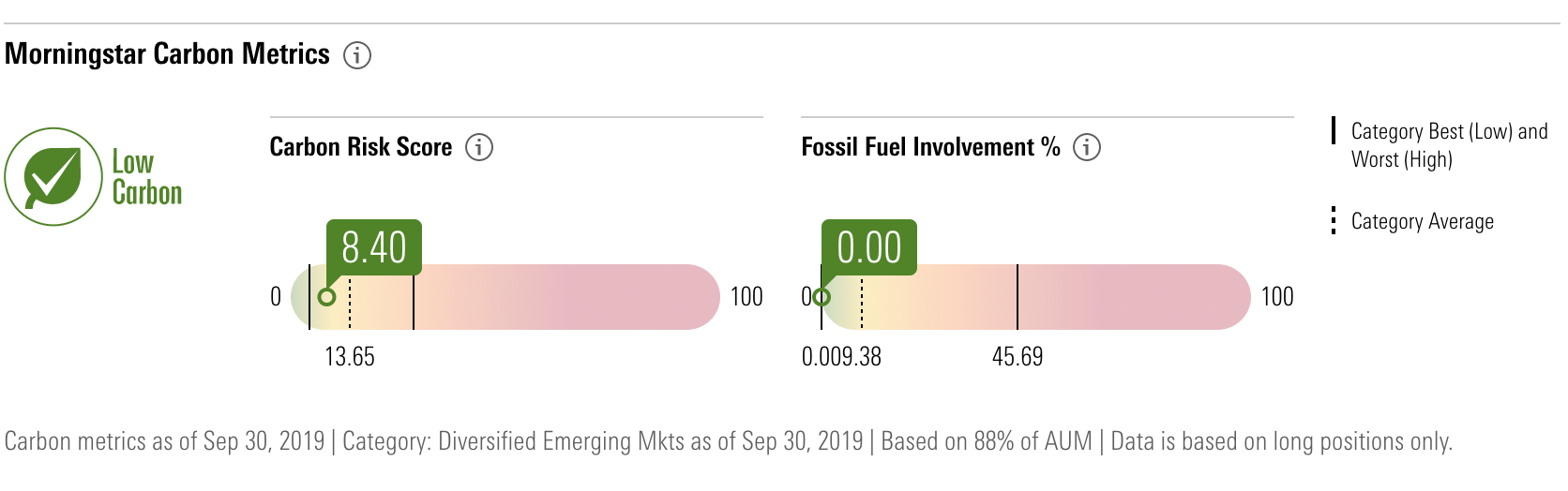

Morningstar Low Carbon Designation

Developed with Sustainalytics, this rating evaluates how well companies in the portfolio are managing their exposure to climate risk by limiting carbon emissions and minimizing switching costs to new technologies. It rolls the company risk scores up into a portfolio-level score.

Look for the Morningstar Low Carbon Designation, which helps investors easily identify funds that have low carbon transition risks and low fossil fuel exposure.

To test your knowledge of sustainable investing, take our quiz.

:quality(80)/cloudfront-us-east-1.images.arcpublishing.com/morningstar/5FNGF7SFGFDQVFDUMZJPITL2LM.png)

:quality(80)/cloudfront-us-east-1.images.arcpublishing.com/morningstar/EOGIPTUNFNBS3HYL7IIABFUB5Q.png)