In part 1 of this article, we looked at how regionally-diversified some of the U.S. ETFs are, in part 2, we will look at diversification in other lenses.

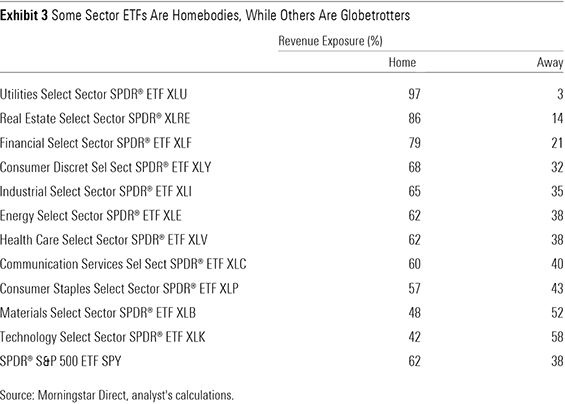

Looking at the data through the lens of sectors provides more insight into these differences in fundamental geographic diversification. Exhibit 3 shows the breakdown between "Home" (the U.S. in this case) and "Away" (ex U.S.) revenue for the Select Sector SPDR ETFs. It should come as little surprise that the utilities, real estate, and financials sectors generate most of their sales in their home markets. These companies' assets and customers are typically landlocked. It's worth noting that these sectors also tend to be those most sensitive to fluctuations in local interest rates.

On the flip side, technology and materials firms sell more outside the U.S. Tech firms like Microsoft (MSFT) and Apple have products without borders and global networks. Materials companies like Linde PLC (LIN) and DuPont de Nemours (DD) have global asset bases, needed to serve a global clientele.

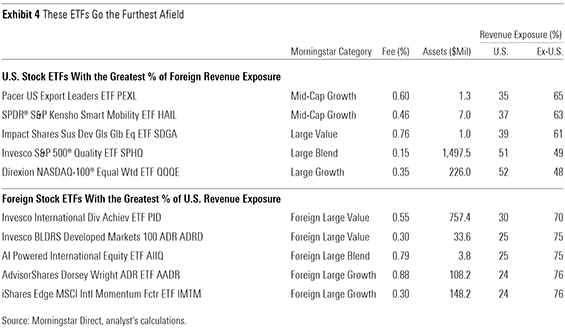

Exhibit 4 includes noteworthy edge cases, those U.S.-stock ETFs with the greatest foreign revenue exposure and the foreign-stock ETFs with the most U.S. revenue exposure. On this measure, Pacer U.S. Export Leaders ETF (PEXL) is delivering as advertised. The fund's benchmark screens the S&P 900 Index for the 200 companies with the greatest percentage of foreign sales before winnowing those 200 down to the 100 with the greatest five-year free cash flow growth. Consistent with the sector-level data in Exhibit 3, PEXL's portfolio is characterized by large allocations to technology (43%) and industrials (14%) stocks, which draw a greater portion of their revenue overseas.

The outliers among the list of foreign-stock ETFs with the greatest U.S. revenue exposure are less extreme. The stocks in Invesco International Dividend Achievers ETF's PID portfolio make just 30% of their sales in the U.S. This is a relatively slight tilt toward the U.S. compared with iShares Core MSCI International Developed Markets ETF IDEV. The difference can be largely attributed to the fact that 44% of PID's portfolio is allocated to Canadian stocks, which have on average relatively greater U.S. revenue exposure.

You Might Be Better-Diversified Than You Think

Even if you have 100% of your equity portfolio invested in U.S. stocks, you're more diversified than traditional measures might lead you to believe. The companies you invest in are effectively diversifying on your behalf as they sell their wares in foreign markets and invest to expand further afield.

That said, the case for owning foreign stocks remains strong. U.S. and foreign stocks have not and will not ever move in perfect unison. Pairing assets that zig and zag at different times in response to different fundamental drivers is a good way to reduce portfolio risk, making it easier to stick to your plan. There will be times when valuations across global markets are out of sync. It is at these moments when taking from your leaders to add to your laggards might not only reduce portfolio risk but also improve long-term returns.

Key Takeaways

- As companies continue to expand their global footprints, traditional means of measuring geographic diversification are increasingly insufficient. Measuring global diversification along dimensions of fundamental exposures--such as revenue--can paint a more-complete picture of funds' degree of diversification.

- Small-cap stocks tend to sell more in their home markets, while large caps make more sales away from home. Favoring small caps may provide more direct exposure to local market fundamentals.

- Some sectors are globetrotters, while others are homebodies. Financials, utilities, and real estate stocks typically have local asset bases and clientele and will tend to be most sensitive to fluctuations in local interest rates. Technology and materials stocks have a more global reach.

- While looking at your portfolio through the lens of regional revenue exposure might show that even the most home-biased portfolios are better diversified than they first appear, the case for owning foreign stocks remains compelling.

:quality(80)/cloudfront-us-east-1.images.arcpublishing.com/morningstar/5FNGF7SFGFDQVFDUMZJPITL2LM.png)

:quality(80)/cloudfront-us-east-1.images.arcpublishing.com/morningstar/EOGIPTUNFNBS3HYL7IIABFUB5Q.png)