Create Your Own Dividend

It isn't necessary to target high-dividend-paying stocks to earn higher income distributions than the market. Sometimes it can be more effective to simply own the market portfolio, with a fund like Vanguard Total Stock Market ETF (VTI, listed in the U.S.), and sell a small percentage of the position each year to generate cash to supplement the market's dividends. Withdrawals of 2% or lower each year should be sustainable, as there's a good chance that earnings per share can grow at that rate (above inflation) over the long term.

This approach yields better diversification than dividend funds, and it avoids the value style risk common to most of those strategies.

There are some trade-offs to consider. Harvesting a fixed percentage of the portfolio each year can result in more-volatile distributions than investing in a dividend strategy, as dividend payments from U.S. firms tend to be more stable than stock prices. However, anchoring the sell rule to the average of the portfolio's values over the past few years can help reduce this volatility. It's also important to keep in mind that withdrawing funds will likely reduce the portfolio's long-term returns. But the same is true of investors who spend their dividends rather than reinvesting them. Perhaps the real downside is that homemade dividends require investors to act, while traditional dividend strategies don't.

Covered-Call Strategies

Covered-call strategies may also be worth considering to boost income. This is where an investor owns a stock (or portfolio of stocks) and writes a call option on that security, giving the option buyer the right to purchase that stock at a set price. In exchange, the option writer receives a premium. This effectively trades the stock's upside potential for current income, but it leaves the investor fully exposed to the stock's downside risk.

At first blush, that seems like a lousy deal. Why would anyone want to keep all the downside risk and cap their gains? If the market is efficient, the premium income the option writer receives should offer fair compensation for this asymmetric risk. But research suggests that the market tends to overvalue these options, owing to loss aversion and demand for upside participation.[1]

While the covered-call strategy is sound in theory, it hasn't worked as well in practice. Consider Invesco S&P 500 BuyWrite ETF (PBP) (0.49% expense ratio), the oldest covered-call ETF listed in the United States. This fund owns the S&P 500 and sells call options on the index expiring in the next month with the closest strike price above the index's current market price, holding these positions until maturity.

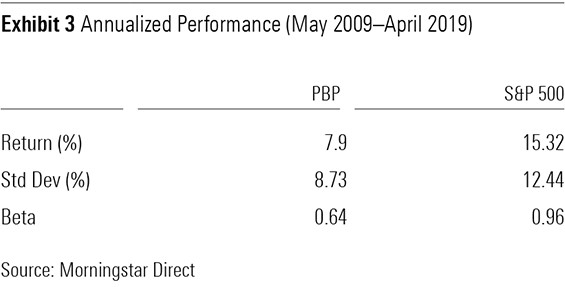

From January 2008 through April 2019, the fund was less volatile than the S&P 500. But it posted considerably lower returns, resulting in less-attractive risk-adjusted performance, as shown in Exhibit 3. That said, it may look better in a weaker environment for stocks.

This strategy was also considerably less tax-efficient than most dividend income strategies. Because of the way this fund is structured, it is subject to a tax rule that requires it to mark its holdings to market daily. That doesn't allow it to defer taxes, and many of its gains are considered short-term.

Income distributions from covered-call strategies tend to be more volatile than most dividend strategies, as option premium income is tied to market volatility, which constantly changes. When expected volatility is low, call options carry smaller premiums because it's less likely they'll end up in-the-money. So, it's not prudent to anchor on these fund's past yields.

Key Takeaways

- Don't blindly chase yield. Stick to broadly diversified portfolios or strategies that screen for both yield and quality.

- Selling a small part of a stock investment each year can be an effective way to boost income.

- Covered-call strategies may offer attractive income and risk-adjusted performance over the long term, but their income distributions can be volatile.

[1] Israelov, R., Neilsen, L., & Villalon, D. 2017. "Embracing Downside Risk." J. Alternative Investments, Vol. 19, No. 3, P. 59.

:quality(80)/cloudfront-us-east-1.images.arcpublishing.com/morningstar/5FNGF7SFGFDQVFDUMZJPITL2LM.png)

:quality(80)/cloudfront-us-east-1.images.arcpublishing.com/morningstar/EOGIPTUNFNBS3HYL7IIABFUB5Q.png)