As the long-term trend toward low-cost investment continues to favour passive solutions, the outlook for the European exchange-traded fund industry remains rosy.

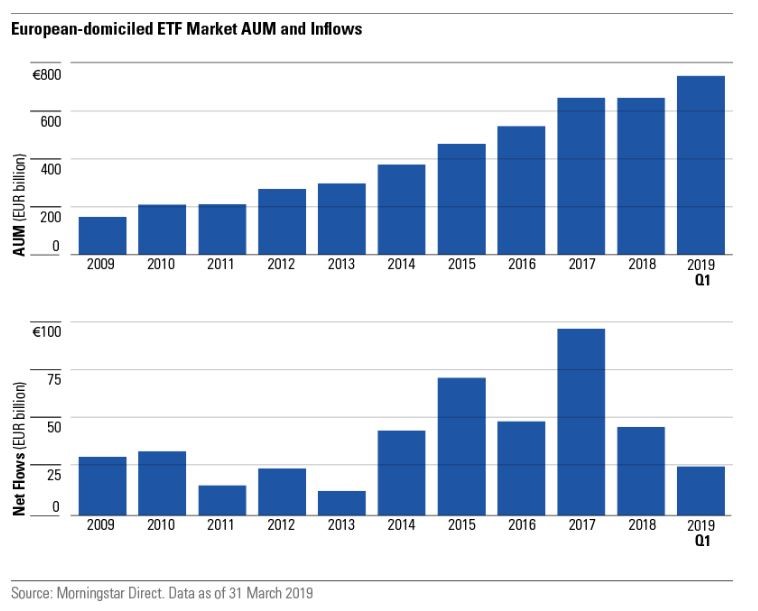

The European ETF marketplace has grown at a rapid clip over the past decade, soaring to about €760 billion of assets under management by the end of first-quarter 2019 – more than a fourfold increase from €160 billion at the end of 2009.

Fixed-income ETFs Gain Ground

When analysed for AUM distribution by broad asset class, we see that the European ETF marketplace remains biased toward equities, accounting for about two-thirds of total AUM at the end of first-quarter 2019.

Although they represent fewer assets overall, fixed-income ETFs have seen strong growth, more than quadrupling over the past five years.

Improvements in bond index construction were one driver of this area’s growth. Additionally, market-makers have found ways to overcome technical barriers that have previously inhibited real-time single pricing.

Three Areas of Innovation

As the space for mainstream exposures becomes increasingly crowded, many ETF providers seek opportunities for product development that allow them to differentiate themselves and/or maintain margins. A few popular areas of product development include:

Strategic beta – one of the key ETF product development battlegrounds of recent years, most new launches now focus on multi-factor equity strategies. Many ETF providers are marketing strategic-beta products as a way to improve the risk/return profile of a broad market-cap index. Diversification across different factors can help curb the impact of long periods of underperformance commonly experienced by single-factor strategies.

Thematic – these attempt to profit from long-term macro or structural trends such as demographic shifts, technological advances, and environmental changes. Tech ETFs, in particular, have caught investors’ attention, with launches covering artificial intelligence, cloud computing, digital security, and e-commerce. AUM growth in this area has been driven by the success of two robotics and automation ETFs (iShares Automation & Robotics ETF; L&G ROBO Global Robotics and Automation ETF).

ESG – sustainable investing has outgrown its niche to become one of the most fiercely competitive areas of product development. Many providers now offer a core set of ESG-focused ETFs that take varying approaches, including ESG integration and hard exclusions. ESG ETFs saw a banner year in 2018: assets grew by 50% to €9.95 billion, and 36 new products came to market, as compared to 15 in 2017.

Ongoing Fee Pressure

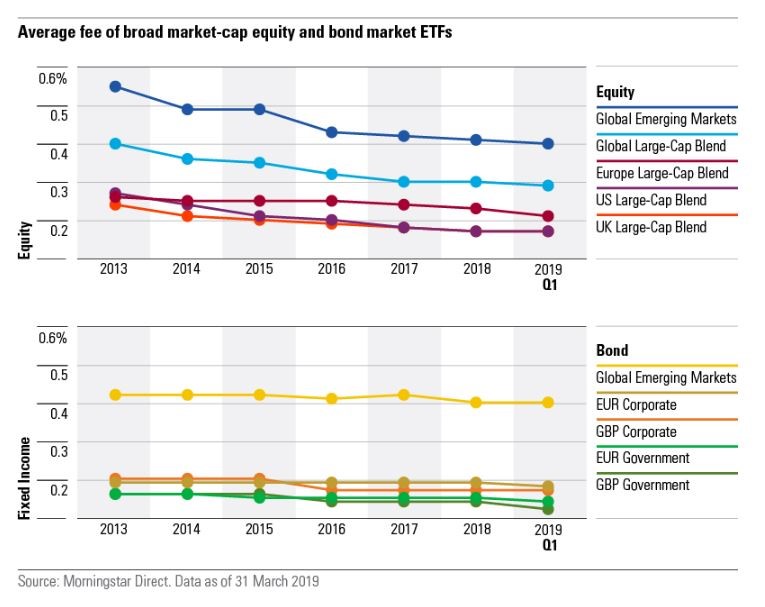

The downward pressure on ETF fees continues to shape the market, both for mainstream exposures and beyond.

Over the past two years, we have seen fee competition intensify across the ETF space, as average ongoing charges have fallen across the main equity and bond categories (as shown on the chart below). This movement may be owed to a growing sense that the development and management requirements of these products do not justify substantially higher fees.

In particular, the field of sustainable ETFs has seen increased fee competition. 2018 saw the launch of several aggressively priced ETFs (from iShares, Xtrackers, and Legal & General Investment Management), which means that investors can now buy a range of sustainable portfolio building blocks without having to pay a premium.

Using the US market as a barometer, we can expect that European ETF fees still have some way to fall.

:quality(80)/cloudfront-us-east-1.images.arcpublishing.com/morningstar/5FNGF7SFGFDQVFDUMZJPITL2LM.png)

:quality(80)/cloudfront-us-east-1.images.arcpublishing.com/morningstar/EOGIPTUNFNBS3HYL7IIABFUB5Q.png)