In part one of this article, we looked at the first key characteristics of dividend ETFs -- dividend yield. In this second part, we will discuss the other two key characteristics -- dividend growth and dividend durability.

Dividend Growth

Investors too often look at dividend yields in isolation, without giving dividend growth its due. Dividend growth is a vital component of the overall income equation, as it will determine the extent to which the expansion of an investor’s equity-income stream will lag, keep pace with, or outstrip the rate of inflation. The goal, of course, is to grow this income stream at a rate that exceeds inflation, in order to grow one’s real (that is, inflation-adjusted) income.

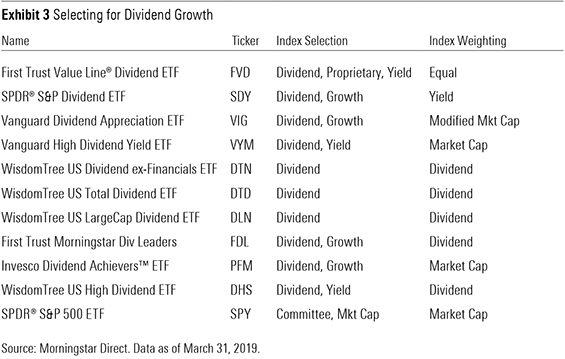

Of the 10 dividend-oriented ETFs included in the sample, four of them track a benchmark that specifically screens its investable universe for firms with long track records of paying and/or regularly increasing dividends. Isolating firms with a long track record of paying and increasing dividend payments is a backdoor quality strategy. These companies tend to be less cyclical and more profitable than most and have healthy balance sheets. In Morningstar parlance, they often have economic moats—durable competitive advantages that allow them to earn juicy profits for extended periods. These firms are often well-positioned to increase dividends over time and will, on average, fare better than the market at large during downturns.

Dividend Durability

Perhaps even more important than dividend growth is the overall stability of the dividend income stream. After all, investors looking to these funds as a source of cash flow would be disappointed to find that their income stream is volatile and may be devastated if they were to take a substantial pay cut.

The financial crisis provided a test case for these ETFs, putting the dividends of the stocks they owned under extreme pressure. For each of the funds in my sample, I calculated what I’ll refer to as their maximum dividend drawdown: the largest year-on-year decline in their annual dividend payment. Unsurprisingly, all four ETFs whose benchmarks specifically screen their constituents based on a steady history of paying and growing dividends had, on average, relatively muted dividend drawdowns. Much like dividend growth, the durability of firms’ dividends speaks to the quality of their franchises, the consistency of their cash flows, and thus, their ability to continue to return cash to their shareholders in the form of dividends even in the trough of an economic cycle.

Putting It All Together

Investors scrutinizing dividend ETFs should consider the following:

1 | Price Fees are the most stable, explicit, and predictable detractor from future performance and will come directly off the top of an investor’s income stream. Look for low-cost funds.

2 | Yield Do not consider yield in isolation. Rather consider it in its historical context, how it stacks up relative to peers, and how it springs forth from the underlying index methodology.

3 | Growth Look for funds that can grow their dividends at an inflation-plus rate over the long haul. Benchmarks that specifically screen for historical and/or prospective growth should have better odds of growing their income streams over time.

4 | Stability Investors should place a premium on income stability, particularly in bear markets. On average, the ETFs in the sample I studied that specifically screen for growing and/or stable dividends fared better during the financial crisis, experiencing relatively muted dividend drawdowns versus their peers.

:quality(80)/cloudfront-us-east-1.images.arcpublishing.com/morningstar/5FNGF7SFGFDQVFDUMZJPITL2LM.png)

:quality(80)/cloudfront-us-east-1.images.arcpublishing.com/morningstar/EOGIPTUNFNBS3HYL7IIABFUB5Q.png)