In part 1 of this article, we looked at the historical evidence of a trend-following strategy. Here we try to test the robustness of the strategy.

Robustness Check

The success of this strategy isn't a fluke. It works with other signals. For example, in place of using the moving average, the strategy would have also been effective by simply holding the stock index if its return over the past year were positive and T-bills if it were negative. This signal is highly correlated with the moving-average signal, but there is no reason to expect one to work better than the other.

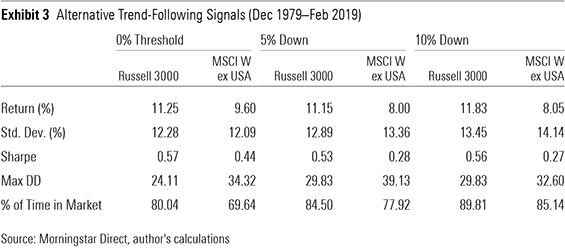

There are other decision thresholds this strategy could use. For instance, a less-conservative trend-following strategy might wait until an investment has a 5% or 10% loss before switching into T-bills. These lower return thresholds keep the strategy invested in stocks longer, which should slightly increase returns and risk, but they should still move to the sidelines before severe losses set in. Exhibit 3 shows the performance of these alternative versions of trend-following applied to the Russell 3000 and MSCI World ex USA indexes, updated monthly. Whichever signal the strategy uses, it's best to update it once a month because it becomes less effective with longer holding periods.

As expected, all three versions of the strategy offered better downside protection and better risk-adjusted performance than the buy-and-hold investments in the indexes. The risk reduction was the greatest when the strategy moved to T-bills if the index's return over the past year was less than 0%. The returns for the U.S. trend-following strategy were slightly higher with the 10% loss threshold, but it was surprising that the returns for the international strategy didn't improve with the lower thresholds.

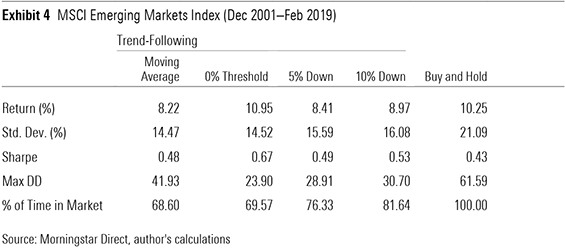

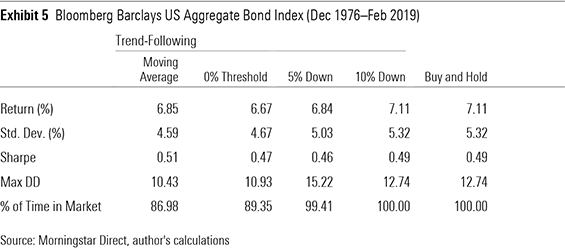

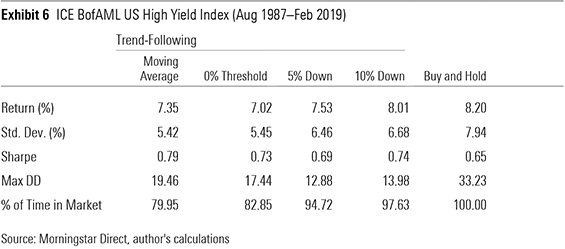

Trend-following also works in other markets. I applied all four versions of the strategy (updated monthly) to the MSCI Emerging Markets, Bloomberg Barclays U.S. Aggregate Bond, and ICE BofAML U.S. High Yield Bond indexes using the full available history of each index. The results are shown in Exhibits 4–6.

In all three markets, trend-following reduced volatility. However, these strategies were more effective for the riskier emerging-markets stock and high-yield bond indexes than they were for the relatively tame investment-grade aggregate bond index. This suggests that the strategy is more appropriate for risky assets like stocks and high-yield bonds than for low-risk investments because the downside protection it can offer makes a bigger difference there.

Caveats

While trend-following appears to be an effective risk-management strategy, it shouldn't be the first line of defense. There's no substitute as strong as adopting a conservative asset allocation if you have a low tolerance for risk.

To be successful with trend-following, it is necessary to have the discipline to follow the signal no matter what. If you don't, it's best not to do it at all. It's also important to be comfortable underperforming the market in extended rallies.

:quality(80)/cloudfront-us-east-1.images.arcpublishing.com/morningstar/5FNGF7SFGFDQVFDUMZJPITL2LM.png)

:quality(80)/cloudfront-us-east-1.images.arcpublishing.com/morningstar/EOGIPTUNFNBS3HYL7IIABFUB5Q.png)