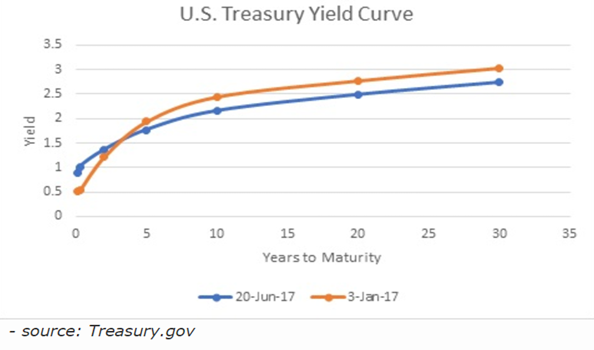

The yield curve has flattened in 2017. As you can see from the chart below (Exhibit 1), short-term yields have risen from where they started the year, while long-term yields are lower than they were in January. In a "normal" yield curve, the short-term yields are lower than long-term rates, because you would expect to be compensated for taking on more risk in the form of longer bond maturity.

Exhibit 1: US Treasury Yield Curve

When the yield curve flattens, the spread between shorter-term bonds and bonds of longer maturities shrinks. This is often measured as the spread or difference between the yield on the 10-year Treasury and the 2-year Treasury. At the start of 2017, the spread was 1.23, and as of Friday it was 0.81 (Exhibit 2).

Exhibit 2:US 10-Year Treasury Constant Maturity minus US 2-Year Treasury Constant Maturity (begin of 2017 ~ 2017/06/23)

Source: US Federal Researve Bank of St. Louis

It's not so difficult to understand what's going on at the short end of the curve: This is the part over which the Fed exercises more direct control. We started the year with the fed funds rate at a range of 0.50%-0.75%. The Federal Reserve has raised rates twice so far in 2017--once in March (to a range of 0.75%-1.00%) and once in June (to 1.00%-1.25%).

What's going on at the long end of the curve gets complicated, though. U.S. investors have experienced a lot of economic uncertainty this year, ranging from what healthcare policies will look like to the likelihood that the Trump administration will be able to deliver on promised infrastructure improvements. Inflation expectations have sagged from around 2% at the start of the year to 1.69% last Thursday, according to the breakeven inflation rate, which compares the yield on nominal Treasuries to the yield on Treasury Inflation-Protected Securities of a similar maturity to estimate the market's inflation expectations. Also, importantly, even though the yields on Treasuries might look anemic to a U.S. investor, low interest rates on global developed debt is helping to anchor the long end of the curve.

A Flattening Curve Doesn't Mean Recession Is Nigh

The markets tend to worry that flattening yield curves mean we're hurtling toward recession. "A flatter yield curve hurts bank profits, stability, and willingness to lend. Also, a flatter yield curve is viewed as a sign of upcoming weakness," said Bob Johnson, Morningstar's director of economic analysis. "If long-term and short-term rates are close, markets must be expecting little growth or lenders would demand a bigger time premium."

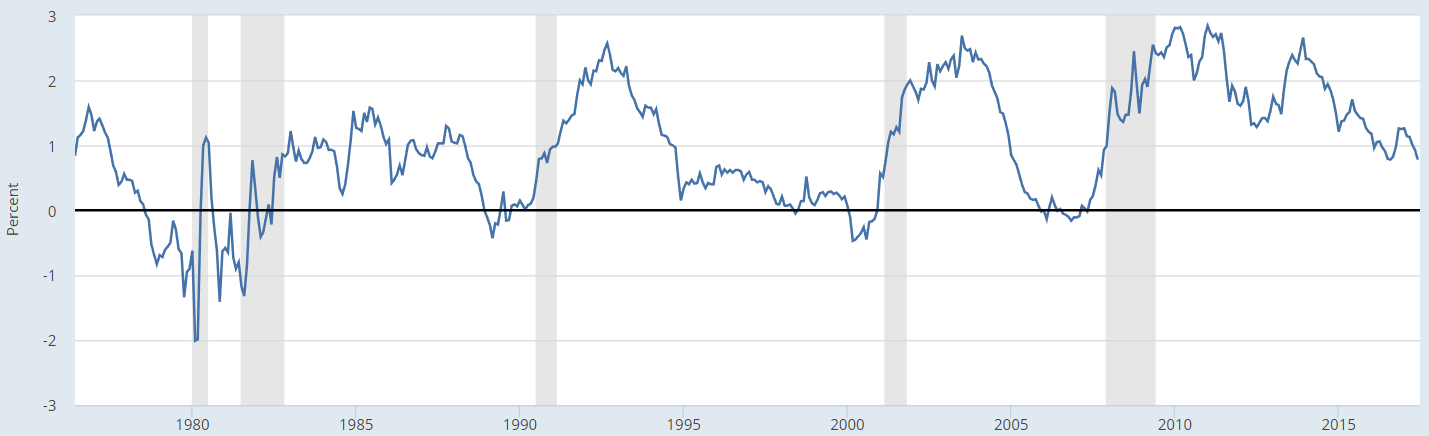

Yield curves sometimes flatten on the way to inversions, which tend to precede recessions. The graphic below from the St. Louis Fed shows the spread between the 10-year and 2-year Treasuries--the peaks are periods when the yield curve was steepest, while the dips below the zero line indicate that the yield curve was inverted. The shaded vertical lines represent recessions.

Exhibit 3:US 10-Year Treasury Constant Maturity minus US 2-Year Treasury Constant Maturity (1976/06/01 ~ 2017/06/23)

Source: US Federal Researve Bank of St. Louis

But as you can see from the chart above, the yield curve can flatten for years without tipping into inversion. Further, comparisons to past cycles may not be all that relevant: The current environment is an uncharted frontier.

"Although the yield curve has historically been a great indicator of where we are in the cycle, we are in an artificial market scenario where central banks around the world are at near-zero rates," said Gibson Smith, former chief investment officer of fixed income and portfolio manager at Janus. "It's hard to interpret that the market is sending signals when there are so many unintended consequences of global accommodative rate policies."

Despite a bevy of weak economic indicators, the Fed raised rates at its June meeting. Johnson believes it had little choice in the matter: Because the Fed had widely communicated its intent to raise rates, failing to do so would have potentially spooked the market, a scenario it definitely wants to avoid. But in addition to not surprising the market, the Fed also needs to be careful it doesn't raise rates too far, too fast. Indeed, the Fed has telegraphed its commitment to normalizing monetary policy, which could involve raising rates to a 3.0% level as soon as 2019.

The Fed "dot plots" show the expectations that each member of the FMOC has for the target fed funds rate through the end of the year and over the next several years. It can give a sense of how many rate hikes might be in the offing. In the most recent release, the dot plots show the median member anticipating a range of 1.25% to 1.5% by the end of the year, implying one more quarter-point rate hike in 2017. 2018 could bring three more quarter-point increases (up to a range of 2.0%-2.25%), and possibly three more in 2019, which would bring us within spitting distance of the Fed's long-term 3% target.

"There's not much room for error here," Smith said. He points out that the Fed has made it clear it is moving into a less accommodative position, even as the oil price declines, high-yield spreads tighten, and the yield curve flattens. Another potential wild card in this tightening cycle is the proposed restructuring of the tax code, Smith said. The Fed needs to tread carefully in its tightening, because if the current administration implements tax restructuring or tax cuts, tightening too much could stymie the potential economic stimulus the tax cuts could provide, he said.

A Tightening Double-Whammy?

The Fed has also indicated it plans to begin reducing its gigantic balance sheet as part of its normalization effort. But it's not certain how the program will proceed, nor how it will affect the economy. As a reminder, the Fed's SOMA is currently $4.2 trillion--the largest it's ever been. Holding massive amounts of securities was how the Fed was able to keep rates at near-zero in the first place, but the balance sheet became so large that the central bank has had to use nontraditional tools to raise its target federal funds rate during this tightening cycle.

Rather than selling financial assets, which could put too much upward pressure on interest rates and could have a destabilizing effect on the bond market, the Fed will start to let the securities in the portfolio mature and prepay--in other words, the balance sheet will start to shrink in an organic way. But even gradually reducing the reinvestment in maturing securities will reduce the supply of reserve balances, which could have the effect of raising short-term rates significantly.

In the Fed's Addendum to the Policy Normalization Principles and Plans released along with the FMOC statement on June 14, it said its plan to unwind the balance sheet includes gradually rising caps. Initially, it would start with $10 billion per month, which isn't a huge percentage of the overall SOMA. But the plan is to ramp up to $50 billion per month, or $600 billion per year.

In the addendum, the Fed said its securities holdings "will continue to decline in a gradual and predictable manner" until the committee thinks the balance sheet is no larger than the level necessary to "implement monetary policy efficiently and effectively."

Johnson said the purpose of the extensive discussion of unwinding the balance sheet in the June release could have been to talk up longer-term rates in order to steepen the yield curve. But if that was the intent, it didn't have the desired result: The approach the Fed outlined was so measured, and it provided so much room to back out, that it didn't panic markets like the 2013 taper tantrum did. "In trying show the market that [the Fed was] going slow, the announcement had the opposite effect on long-term rates," Johnson said.

Going forward, Johnson believes it's unlikely that both a fed funds rate hike and a significant reinvestment change will take place at the same meeting. "I think [the Fed] wants an independent way to evaluate which is more effective or less harmful to the economy. And a desire not to shock the market with two simultaneous changes," he said. So, even if the flattening yield curve on its own doesn't herald imminent danger, uncertainty abounds. And though the Fed has made it clear that monetary policy normalization is in the cards, it needs to ensure it doesn't overplay its hand.

:quality(80)/cloudfront-us-east-1.images.arcpublishing.com/morningstar/5FNGF7SFGFDQVFDUMZJPITL2LM.png)

:quality(80)/cloudfront-us-east-1.images.arcpublishing.com/morningstar/EOGIPTUNFNBS3HYL7IIABFUB5Q.png)