After reliably and consistently beating growth companies for decades, lower-priced stocks have lost their edge. Since the mid-1990s, value stocks have roughly matched growth stocks' returns, and during the trailing 10-year period they have lagged.

In his most recent quarterly letter, Jeremy Grantham, co-founder of the money-management firm GMO, discusses why value investing has struggled. The letter is unusual in that Grantham is himself a value investor, and his organization's funds are suffering net redemptions. Fund executives who find themselves on the wrong side of the financial markets tend to defend their investment approach, not question it.

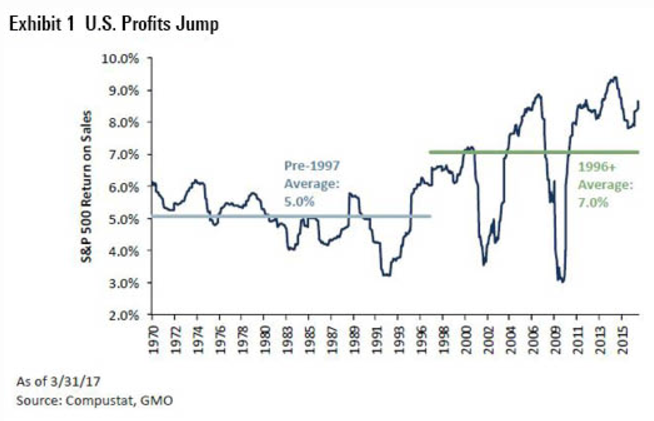

Instead, Grantham grants that this time might indeed be different. In particular, corporate profits have transformed. Grantham provides the return-on-sales figures for the S&P 500, dating back to 1970. For the first half of the period, the ROS hovers between 4% and 6%. It's artificial to draw a line at 5%, which Grantham does, as if that number represents the sequence's natural midpoint. However, such an exercise does capture the previous spirit of the ROS' behavior.

Then all heck broke loose. The ROS burst through its 25-year band in 1996 (while Alan Greenspan mused about "irrational exuberance"), set another record in 2000, beat that mark again in 2007, and surpassed it once more in 2014. In the period's second half, the past served as no guide whatsoever for the future. Grantham draws another line, illustrating the new equilibrium, but this action is even more artificial than his first. Who can tell where the ROS is headed?

Interest rates, of course, have also confounded expectations by breaking through their historic bands. In the case of interest rates, the barriers were floors rather than ceilings. But the pattern was the same as with corporate profitability. Rates would set new records, observers would whisper worries about their inevitable retreat, and then … interest rates would drop further. The bad news never came.

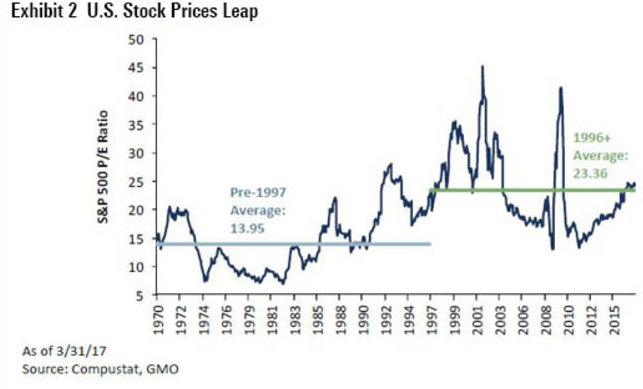

Given that corporate profits exceeded all predictions, and interest rates dropped below what anybody anticipated, it's no surprise that stock price/earnings ratios moved higher. How could they not? Corporate values are determined by the cash that companies generate (which is directly related to profitability, assuming no hanky-panky with the accounting) and by the interest rates that are used to discount their future receipts. Both measures improved greatly. Stocks had no choice but to rise.

Trend Fighters

Value investors are creatures of habit. Whereas growth investors cherish the improbable, envisioning companies that achieve what their predecessors could not accomplish, value investors expect what previously occurred to happen again. Grantham's lines are symbolic, but they represent the bedrock faith of a value investor: That which excels (or stumbles) will inevitably head back from whence it came.

(The same precept holds true for value-minded asset allocators. Those who use the Shiller CAPE Ratio to judge whether U.S. stocks are fairly priced assume that the ratio should fluctuate around its long-term average. In their view, although it may look at the time that the mean is evolving, that is an illusion; ultimately, the reversion will occur.)

Historically, value investing succeeded for two reasons:

As a rule (there were always exceptions), the weaker companies weren't quite as bad as they seemed. If they were priced the same as the stronger companies, of course you would prefer the latter, but that was not the case. The laggards were steeply discounted--too steeply, as it turned out.

Conversely, the stronger companies weren't as good as they seemed. Their prospects were overstated. To be sure, they ended up growing their sales and profits faster than the norm, but not as rapidly as their stock prices had forecast.

In short, stock investors typically overreacted in both directions. They accurately gauged that some companies were better than others, and for the most part sorted the sheep from the goats, but they misjudged the magnitude. The good weren't that good and the bad weren't that bad.

The New Era

This time, the mean did not revert. True, the bad companies have remained not so bad. (Setting aside the companies that did not survive the 2008 crisis, that is.) That part value investors continue to get right. However, they have missed the fact that the good companies have indeed become that good. For 20 years, Apple has confounded even the optimists. Apple is the most extreme of cases, but across the technology and healthcare industries, leading firms enjoy margins as they never have before.

Writes Grantham, "I used to call profit margins the most dependably mean-reverting series in finance. And they were through 1997. Previously, margins … were competed down to a remarkably stable return--economists used to be amazed by this stability--driven by waves of capital spending just as industry peak profits appeared. But now … there is plenty of excess capacity and a reduced emphasis on growth relative to profitability." Overall, he states, "the general pattern … is entirely compatible with increased monopoly power for U.S. corporations. Put this way, if they had materially more monopoly power [than in the past], we would expect to see exactly what we do see."

Grantham concludes that value investors are unlikely to thrive until corporate profits recede, which he does not expect to happen any time soon. Of course, predicting the economy is a perilous task, but I believe Grantham is on the right track. The primary reason value investing has lost its mojo is not because stock buyers are behaving any differently, but because companies are. The economy has changed the investment math that Eugene Fama and Ken French so famously publicized. If that math is to hold again, it will require the economy's cooperation.

:quality(80)/cloudfront-us-east-1.images.arcpublishing.com/morningstar/5FNGF7SFGFDQVFDUMZJPITL2LM.png)

:quality(80)/cloudfront-us-east-1.images.arcpublishing.com/morningstar/EOGIPTUNFNBS3HYL7IIABFUB5Q.png)