In Berkshire Hathaway's annual report to shareholders, Warren Buffett expressed disdain for financial reporting practices that deliberately inflate earnings figures in an attempt to "make the numbers." "Charlie and I want managements, in their commentary, to describe unusual items--good or bad--that affect the GAAP numbers. After all, the reason we look at these numbers of the past is to make estimates of the future. But a management that regularly attempts to wave away very real costs by highlighting 'adjusted per-share earnings' makes us nervous. That's because bad behavior is contagious: CEOs who overtly look for ways to report high numbers tend to foster a culture in which subordinates strive to be 'helpful' as well. Goals like that can lead, for example, to insurers underestimating their loss reserves, a practice that has destroyed many industry participants."

A shareholder asked Buffett why EBITDA is not a good parameter to value a business in their opinion. Buffett said it's a "very misleading statistic and it can be used in pernicious ways."

What Is EBITDA?

EBITDA stands for earnings before interest, taxes, depreciation, and amortization. EBITDA can be somewhat fuzzy compared to earnings calculated using generally accepted accounting principles, or GAAP, because EBITDA is not standardized. It allows company management latitude to add and subtract items in a number of different ways to highlight what, in their opinion, is the truest earnings power of the business, separate from financing decisions and tax rates.

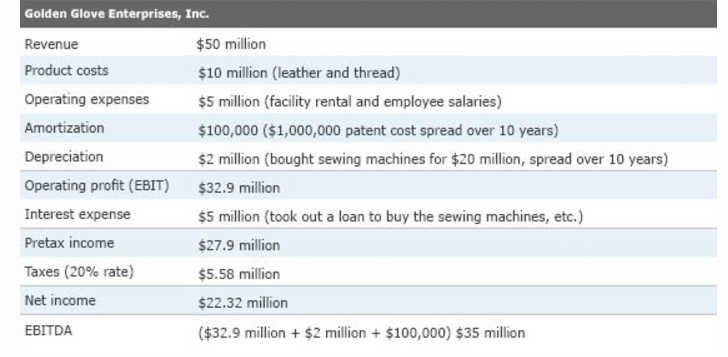

Let's create a small company that sells baseball gloves that are guaranteed to catch more fly balls than any other baseball gloves on the market. The gloves are patented, and that patent is good for 10 years and costs $100,000 (including legal fees). Here is the annual financial statement for our company.

One of the main problems Munger and Buffett have with EBITDA is omitting that depreciation figure, which is a very real expense, in their opinion. Depreciation and amortization are considered noncash items because they do not represent an actual yearly expenditure (no actual cash moves).

In our example, the $20 million expenditure for the sewing machines is being depreciated over 10 years, at a rate of $2 million per year. Of course, in reality the company already spent (or borrowed) the full $20 million to acquire the machines, but we are using straight-line depreciation and spreading the cost out (also, in the real world, the sewing machines would likely have some sort of salvage value, but for simplicity's sake, in our example we will assume they are worth nothing after 20 years).

So, one important thing to understand is EBITDA is not the same as free cash flow. A firm's free cash flow can be calculated in different ways, but it is usually includes capital expenditures, which, as Buffett and Munger point out, are real expenses that need to come out of the company's coffers at some point.

To Buffett and Munger's point, though, if Golden Glove was a public company, it would certainly benefit from using the EBITDA figure to report earnings, as a larger number in the numerator would yield a larger earnings-per-share figure. Note that all earnings releases that use non-GAAP numbers have to also include a reconciliation, however.

When Is EBITDA Useful?

In real-world applications, financial statements get much more complicated than the one we created for Golden Glove Enterprises, Inc. Often it helps to consider multiple metrics in order to get the fullest understanding of a company's profitability, efficiency, and competitive positioning.

Morningstar's philosophy of stock investing is that a firm's intrinsic worth, or fair value estimate, is equal to the value of the cash the business can generate in the future. Our equity analysts estimate future cash flows and discount them over a multiyear period by a discount rate, the key driver of which is the cost of equity for most firms. Therefore, Morningstar analysts pay close attention to a company's free cash flows.

It's harder to get "creative" with free cash flow than it is with EBITDA (though certainly not impossible). But that doesn't mean EBITDA doesn't have its place in our analysis, too. For example, free cash flow is particularly poor at valuing a company that has a lot of debt on its balance sheet, such as a company that funds an acquisition with debt. Also, excluding the depreciation and amortization items, as well as the tax (which is beyond the company's control) and interest expenses (which is a financing decision), can give an investor or analyst a different (in some cases unobstructed) view of a company's profitability, which can facilitate comparisons between companies.

Mike Hodel, a portfolio manager in Morningstar Investment Management focusing on dividend select portfolios, says he views EBITDA like any other tool in valuation--it can be helpful but can also be abused, especially when viewed in isolation. Hodel points out that depreciation itself is often a made-up number, with asset values assigned in random ways (especially in M&A situations); in addition, assumed useful lives often not reflective of economic reality, he said.

"EBITDA lets you put companies in similar industries but with differing histories on a more level playing field," he said. "So, I can look at EBITDA and EBITDA margin along with the level of capital intensity to get a feel for the relative efficiency of two firms." For instance, Hodel says differences in tax rates and interest costs are important, especially for valuation, but they are usually less interesting when an analyst or investor is trying to understand how a firm is positioned competitively, how well a firm is run, etc. "In short, GAAP earnings are, in my mind, no less flawed than EBITDA or any other financial measure. I want to understand the financial statements from top to bottom to ferret out differences between firms and areas where the numbers aren't telling the whole story," Hodel said.

:quality(80)/cloudfront-us-east-1.images.arcpublishing.com/morningstar/5FNGF7SFGFDQVFDUMZJPITL2LM.png)

:quality(80)/cloudfront-us-east-1.images.arcpublishing.com/morningstar/EOGIPTUNFNBS3HYL7IIABFUB5Q.png)