In this paper, we wanted to understand if women had equal opportunities within the industry comparative to her male peers. We did so by constructing a model to reveal historical relationships between managers, funds, firms, geography, and how such factors adjust the likelihoods of having a fund managed by a woman.

Across 56 countries, about one in five funds has a woman manager, a figure that has not improved since the global financial crisis of 2008, women have not made sizable gains in managing the world's mutual funds. We also find the rate of women fund managers is lower than the rate of women in other professions with similar education requirements, such as doctors and lawyers. Countries with large financial centers have lower proportions of women fund managers than many smaller markets. In general, we found that women are underrepresented in fund manager roles worldwide, but we found some areas where women are making some gains. More findings are summarised as below:

Women are less likely to manage active funds

One of the most statistically significant findings of our study is that a woman is more likely to manage a fund that closely tracks an index than manage a fund that is actively managed, meaning it deviates from the benchmark index. The odds of a woman managing a passive fund over an active fund in the same asset class is 1.36:1. For a fixed-income fund, her odds of being named a passive fund manager over active are 1.23:1. And a woman's odds of running a passive allocation fund versus an active fund are the highest: 1.41:1.

At first glance, we could assume that women are benefiting from a growth area for the industry. One might argue that women are earning jobs as passive fund managers because more passive funds are being launched, and it appears easier for a woman to earn a newly created position than unseat the existing manager of an established fund. Our study's construction, however, suggests that women's odds are improving beyond industry growth. In our model, we controlled for both the age of the fund and the manager's experience level. We also ran our study each month to capture as much of the industry shift to passive management as possible. Put another way, the controls allow us to determine whether a woman's odds of managing a passive fund have increased or decreased absent of industry trends, and we find that women still are far more likely to manage passive funds than active funds.

Conversely, our study found that women have lower odds of managing an active fund, which is a longer-established portion of the mutual fund industry. We do not suggest, however, that women are moving from active to passive management. Women--and men, for that matter--need different skills to manage active versus passive funds. With active funds, the manager aims to deliver higher returns than the fund's benchmark index by assembling a group of securities--or portfolios of securities. Active managers are responsible for every investment decision. With passive portfolios, the fund manager's objective is to deliver returns that match the benchmark and ensure that the owned securities meet the outlined investment criteria.

Our analysis cannot tease out whether women are being disproportionately offered passive-management roles or if they are actively choosing to do so. Regardless, the data tells us that the average woman fund manager is less likely to be involved in active management.

Women are managing funds of funds at an increasing rate

Since the start of our study, across asset classes, women fund managers have had increasing odds of being named a fund-of-funds manager. As the name suggests, funds of funds' holdings are not individual securities, but other funds. For equity funds of funds, the relative likelihoods for women increased to 1.49:1 from 0.96:1 over the course of our study. Women were far less likely to run a fixed-income fund of funds at the beginning of the measurement period, but a woman's odds of being named portfolio manager improved significantly to 0.96:1 from 0.52:1. The best odds of a woman being named portfolio manager of a fund of funds rests with allocation offerings. The odds fluctuated, starting at 1.35:1 and ending at 1.30:1.

These results--combined with our earlier findings about passive funds--suggest women are less likely to manage portfolios that center on individual security selection and more likely to allocate assets, select managers, or implement indexing strategies.

Shifting Opportunities for Women in the Fund Industry

The largest equity firms are more likely to hire women portfolio managers. Our study considered whether women had better odds of being an equity fund manager at a large firm rather than a small firm, and we found that larger is better. Among funds at one of the top 10 largest firms by global equity assets under management, a woman's odds of being named an equity fund manager are 1.83:1 relative to earning the same role at a smaller firm.Intuitively, this makes sense: The larger the firm, the larger the number of funds, the larger the number of people managing funds, the more opportunities for a woman to be named to a management team.

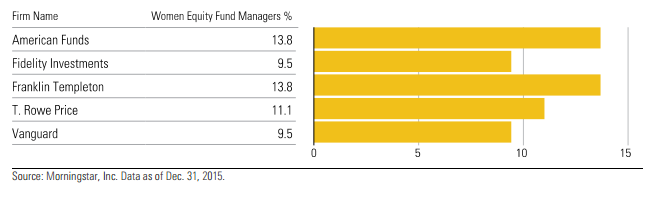

Next, let us look at gender diversity at the largest fund firms by global equity assets under management and how it compares with the global average. Worldwide at an equity firm, 7.7% of equity fund managers are women. Over the course of the study, five firms--American Funds, Fidelity Investments, Franklin Templeton, T. Rowe Price, and Vanguard--remained among the 10 largest equity fund companies, and the percentage of women equity fund managers exceeded the industry average at each firm. Yet these firms are far from gender equal. As of December 2015, their rates of women equity fund managers ranged between 13.8% and 9.5%.

Exhibit 1:% of Women Equity Fund Managers at Largest Firms by Global Equity Fund Assets Under Management

In short, we find the women managers are more likely to have a CFA and to manage in teams, rather than on their own. Not surprisingly, the best chance of finding an equity fund run by a woman is at the largest equity firms. Yet, times are shifting for women in the industry. Socially responsible investing, a market niche previously heavily associated with women, is now attracting men at a rapid pace. Across asset classes, women are managing funds of all sizes.

:quality(80)/cloudfront-us-east-1.images.arcpublishing.com/morningstar/5FNGF7SFGFDQVFDUMZJPITL2LM.png)

:quality(80)/cloudfront-us-east-1.images.arcpublishing.com/morningstar/EOGIPTUNFNBS3HYL7IIABFUB5Q.png)