There is a perpetual debate in financial markets about the relationship between valuations and future earnings growth. If we think through the logic, there are two fields of thought:

First, a statistically-minded investor would say that a high price-to-earnings ratio means an investor should expect higher earnings growth rates. Said simply, why would anyone want to purchase something that is more expensive unless they assumed the payoff would be higher? If Company A has a price-earnings ratio of 10x and Company B has a price-earnings ratio of 20x, Company B is expected to deliver higher growth rates to justify the cost.

Second, the opposing approach from a behaviourally-minded investor would suggest that valuations are a function of cycles. Specifically, low valuations tend to happen when people are scared, which typically occurs around the bottom of the earnings cycle. This provides a low base, and a platform where earnings growth is easier to achieve. High valuations, on the other hand, are potentially subject to a cyclical downturn which could put pressure on valuations.

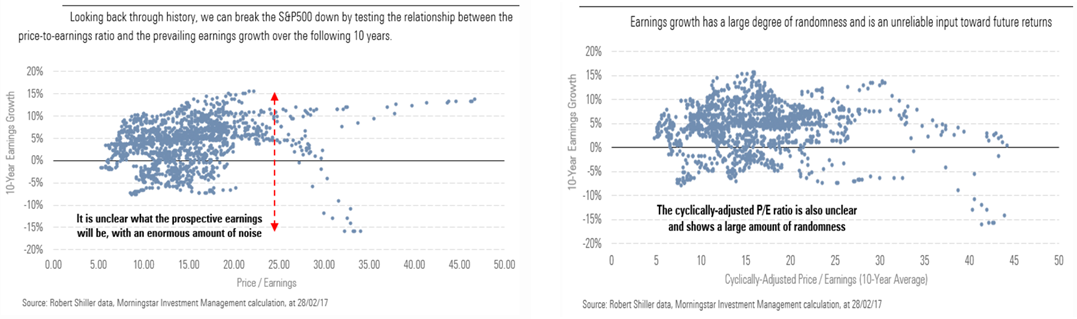

Both of these applications can make sense – however, we strongly warn against making such extrapolations. Below is the evidence on the historical relationship between U.S. valuations, using both the price-earnings (exhibit left) and cyclically-adjusted-price-earnings (exhibit right) of the S&P500, and the earnings growth that follows.

We can see enormous scope for error, which proves why it is a major mistake to justify today’s record prices based on an expectation for sustained higher future earnings. History tells us this simply isn’t guaranteed and will be subjected to a large dose of randomness.

Of course, there are countless explanations of why this randomness takes place – including shifting sector composition, offshore earnings changes and tax regime changes; to name a few – but the simple message of randomness and unpredictability remains unchanged.

It begs the question why analysts obsess over earnings growth assumptions, and furthermore, begs the question why investors listen to these assumptions. Should investors accept this large margin for error? Or do they look beyond this relationship to more reliable sources of information? We advocate the latter. The extreme range of outcomes have far too much scope for error – from -16% to +16% per year over 10 years – so we believe there are inherent dangers in using earnings growth assumptions as a means of understanding future return potential.

:quality(80)/cloudfront-us-east-1.images.arcpublishing.com/morningstar/5FNGF7SFGFDQVFDUMZJPITL2LM.png)

:quality(80)/cloudfront-us-east-1.images.arcpublishing.com/morningstar/EOGIPTUNFNBS3HYL7IIABFUB5Q.png)