Bonds certainly sound safer than stocks. They are required to pay their stated interest rates, whereas stocks can cut their dividends at any time—if they pay dividends in the first place. Bonds, of course, also stand higher on the credit ladder. Should the organization go under, bondholders will likely receive at least a partial payment, sometimes even better than that. Stock owners will get nothing.

In addition, about half of U.S. bonds come courtesy of the federal government. General Motors, Kodak, Woolworth’s, Arthur Andersen, and American Airlines went bankrupt and stiffed their stock shareholders. While those companies would have liked to have possessed printing presses with which to pay their bills, they did not. However, Uncle Sam does. And its debts are denominated in the currency that it prints. The U.S. won’t be defaulting on its obligations any time soon.

This is all stating the obvious: People understand and appreciate the protections that are provided by high-grade bonds, particularly U.S. federal debt. Indeed, the term “government guaranteed” is so powerful that the SEC prohibits mutual funds from using it in their names. (The words once were permitted, but were banned when the SEC realized that many investors interpreted the term to mean that the fund couldn’t lose money.)

Comparing the Records

Not so obvious is the damage that bonds can inflict on portfolios. I need not instruct this audience about interest-rate risk—but I can remind it that the concept is not intuitive. Perhaps because of this lack of intuitiveness, and even more because investment returns are typically given in nominal rather than real terms, even knowledgeable investors can overestimate bonds’ safety.

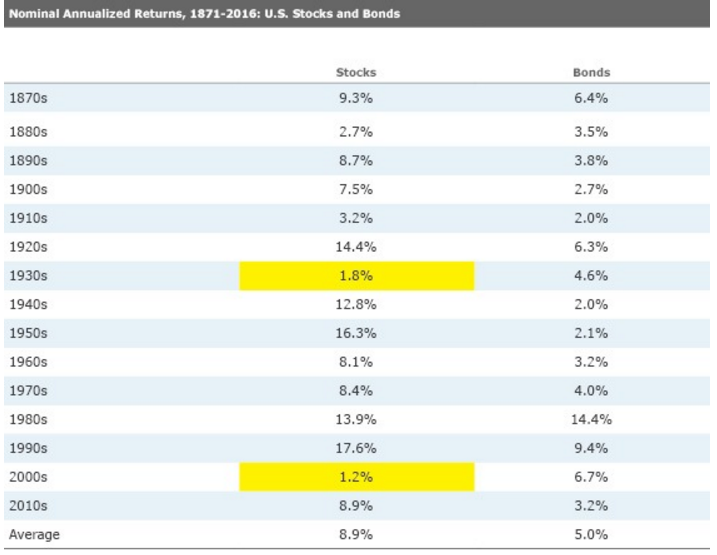

Bonds’ decade-by-decade performance has been slightly steadier than that of stocks, when expressed nominally. In the table below, I’ve shaded losing performances in red, those with annualized gains of 0% to 1.9% in yellow, and left unshaded any gain of 2% of higher. (The numbers come courtesy of Research Affiliates, supplemented by Morningstar.) The first glance confirms initial expectations. The lowest two decades came from stocks. However, the next three weakest showings came from bonds. Not outright losses, to be sure, but nonetheless not according to bonds’ reputation. One would expect them to finish in the middle, with stocks sandwiching them above and below.

Table 1:

Sources: Research Affiliates, Morningstar

The typical investor may not know that from decade-long perspective, bonds have offered only modestly better protection than stocks. Most are highly experienced and therefore avoid the common traps. However, even the savviest may be taken aback by the next table. I was.

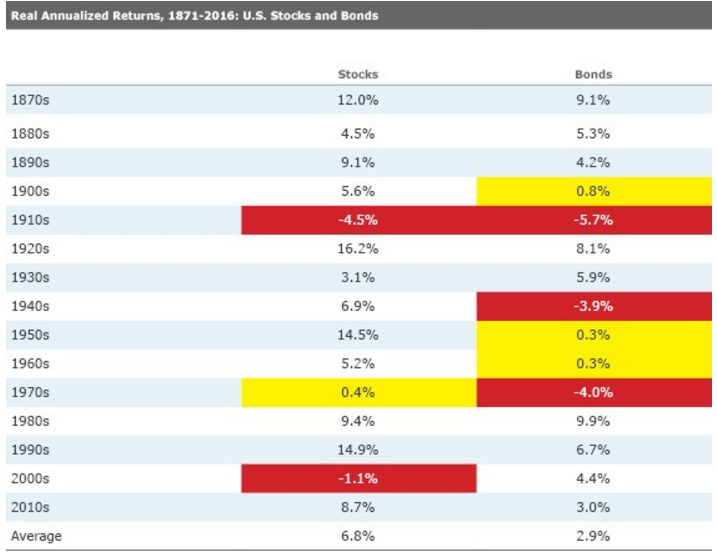

Table 2:

Sources: Research Affiliates, Morningstar

Now, the red appears, severely. Bonds lost 5.7% annually from 1910-19, and stocks fell 4.5%. Those were the weakest two performances out of 30—which is just as well, because they were brutal. Cumulatively, the decade’s worth of investing in stocks would have turned a dollar into $0.63. For its part, one dollar into bond would have become two quarters and a nickel. The thrifty and prudent were not rewarded.

Not only did bondholders lose the contest during the worst of the decades, but they also posted the next two lowest results, shedding 4% annually during the 1970s and almost as much, 3.9%, during the 1940s. That makes three clattering bond-market catastrophes in 15 chances—a 20% failure rate. Meanwhile, stocks had a second losing decade of their own, but the cumulative effect was a modest 10% loss. The 2000s weren’t much fun for stockholders, but they weren’t a disaster for those who bought and held.

On the flip side, stocks performed as one would expect. They had the first, second, third, and fourth highest performances, with booming annualized returns that ranged from 12% all the way up to 16.2%. Such gains would have compensated for severe relative losses. That they came accompanied not by larger selloffs, but instead by shallower downturns relative to bonds, made stocks a win/win.

The Longer View

In a sense, one can argue that this presentation minimizes bonds’ failings. As the market historian Peter Bernstein pointed out, the year-by-year and even decade-by-decade reckonings disguise the fact that, broadly speaking, there have been only two bond regimes within most of our lifetimes: bad, then good. From the 1940s through the early 1980s, U.S. bonds were a thoroughly miserable experience. In real terms, they dropped like a stone, then barely eked out a profit for 20 years, and then once again fell. They failed not one but two generations of retirees. Then they rebounded, and have consistently been good to excellent for the past 35 years.

Viewed from that angle, bonds have been far more frightening than equities. Yes, stocks endure some very unpleasant years, and on occasion an unpleasant decade. But if the downturn occurs because of inflation, companies raise their prices, which enables them, over time, to maintain or even increase their real earnings—and thus the real cash that they can make available to their shareholders. Bonds have no such recourse. If their initial yields greatly underestimate the level of future inflation, then their prices never catch up. They lose and lose and lose.

:quality(80)/cloudfront-us-east-1.images.arcpublishing.com/morningstar/5FNGF7SFGFDQVFDUMZJPITL2LM.png)

:quality(80)/cloudfront-us-east-1.images.arcpublishing.com/morningstar/EOGIPTUNFNBS3HYL7IIABFUB5Q.png)