It is easy to dismiss new funds as an immature, unproven, and unimportant segment of the asset-management industry. But the truth of the matter is that the asset-management industry is dominated by new funds. Globally, we find that new funds account for the preponderance of new asset flows. In 2015, global fund flows reached approximately $516.4 billion across the three asset classes in our study--equity, fixed income, and allocation. Of the total, new funds with less than 12 months of track record accounted for $379 billion, or 73% of all flows. Even in years when the industry experiences net outflows, new funds continue to garner assets. In 2014, new funds grabbed $316 billion in net inflows compared with negative $526 billion in net outflows for funds with greater than 12 months of track record.

In this article, we explore the relationship between observed investor preferences for and eventual investor outcomes in newly launched funds. To conduct this exploration, we built two models that unpack the historical correlations between both forward risk-adjusted returns and forward cumulative fund flows with observed fund characteristics, economic regimes, and category environs. In isolation, each model offers us a multivariate view of the factors that drive future flows and risk-adjusted returns for newly launched funds. By comparing the outputs from the two models, we can also identify potential conflicts of interest for asset managers. A variable that has tended to result in higher flows but lower returns, for example, socially responsible investing, presents a difficult choice for asset managers over whose interests to prioritize.

This tension between what investors have preferred and the outcomes investors are seeking also highlights poor choices on the part of the investing populace. We find that investors have been inconsistent with how they allocate their assets among newly launched funds. For example, we find that investors prefer cheaper funds that, not surprisingly, tend to result in better outcomes. But we also find that investors prefer funds that invest in more-popular, familiar stocks that have done well recently when the opposite choice would have resulted in better risk-adjusted returns.

Newly launched funds are of particular interest to us as they often lack information that we know investors use to make decisions. From prior work, we have observed that investors exhibit strong preferences for funds with strong performance track records. While this is perhaps not surprising, it does raise the question of what information investors use to make an investment decision when a performance track record is unavailable. Despite the lack of information on newly launched funds, we have already presented evidence that new funds can garner immense assets almost immediately.

Given the lack of relevant data early on in the life cycle of a fund, variable selection and variable definition were critical choices in our study. Variables included in the model had to be both widely available in our sample and hypothesized to be relevant drivers. We included 23 variables in the fixed-income and allocation models. In the equity model, we were able to expand this number to 39 because of the quality of Morningstar's equity data and portfolio holdings database.

Many variables included in the model are to be expected: fees, firm-level characteristics, index fund, socially responsible, and portfolio disclosure. However, some variables are less common. Category-level data points such as market concentration and firm market share by category were constructed specifically to examine the role of category structure on newly launched fund outcomes. Furthermore, we also examined Manager CFA Ownership data point, which captures the extent to which the manager of a newly launched fund is buying stocks in a manner similar to the typical manager who is a CFA charterholder.

In general, we attempted to capture various perspectives of a new fund by focusing on data categories such as fund structure, manager demographics, firm reputation, competition within category, portfolio disclosure, portfolio style, and economic regimes.

For the purposes of this paper, we define newly launched funds as any fund with less than 12 months of track record. We do not consider a newly offered share class to be a new fund. We are only interested in brand-new funds. We include open-end funds and exchange-traded funds in our sample. All explanatory data that we use would have been available within that first year. The variables we are trying to explain are forward 36-month risk-adjusted returns and forward 36-month cumulative fund flows. The study is global and begins in January 2005. The last new funds to be included in our study were launched by March 2013. The first 2 findings are as below:

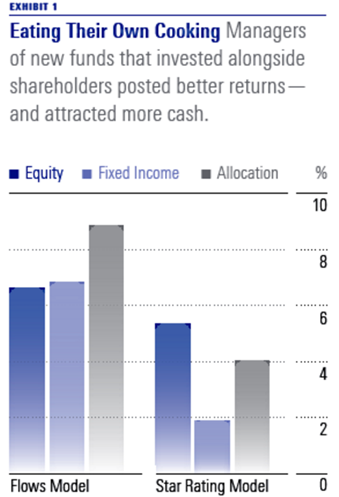

Finding 1: Managers who own their funds have historically performed better and garnered more assets

Fund management ownership is an excellent signal for investors. Data from our study indicates that portfolio managers who have their financial interests aligned with investors run higher-quality funds. Investor preference for such ownership outpaces the benefit of higher risk-adjusted returns. A typical equity fund will have on average 5.5% higher risk-adjusted returns and will move up 6.5 percentiles for flows within its category. For fixed income and allocation, the benefit is more dramatic, 1.9% and 4.0% increases in risk-adjusted returns, with a 6.9% and 8.9% percentile flows increase, respectively.

We did not differentiate between the levels of manager ownership, only noting whether or not a single manager had at least $1 in the fund. We noticed a significant number of funds report no manager investment in their funds. By doing so, the fund is effectively sending a signal that the management team's financial interests are not aligned with their end investors' and they are not willing to do so, even at a minimal cost. Not doing so suggests that the funds may be losing out on future business.

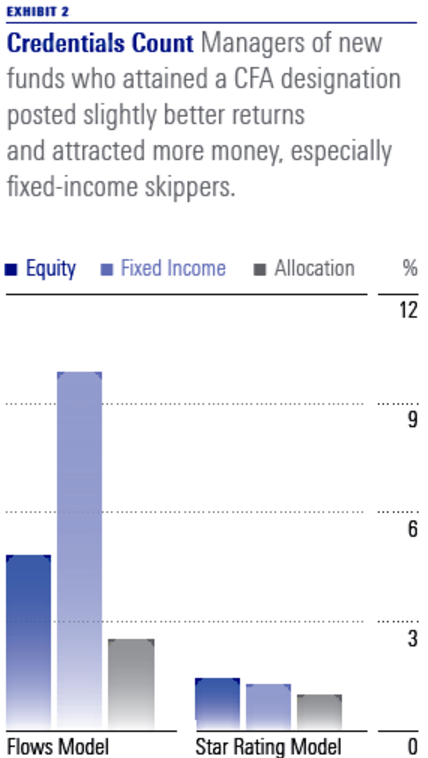

Finding 2: CFA Charterholders achieve better outcomes and are preferred by investors

Investor preferences for CFA-designated portfolio managers follows similarly to their preferences for manager ownership. While the average increase in fund returns across asset classes ranges from 1.1% to 1.5%, the expected average flows varies among fund type. Fixed-income investors display the strongest preference for managers who are CFA charterholders, as the average benefit is a 9.8% increase in category flow percentiles. Equity and allocation funds on average receive a 4.7 and 2.5 percentile increase, respectively.

Investors have imperfect knowledge about a manager's capabilities, so they are likely using the CFA charter as a proxy for skill and education. Our study shows the signal is a beneficial metric to investors from the perspective of improving their long-term performance, too. Interestingly, the preference varies dramatically across asset classes. This tells us the importance of a more educated manager differs for investors depending on the investment type. Yet, the effects in terms of outperformance are very similar, regardless of asset class. Regardless of the magnitude, having a fund managed by a CFA charterholder has resulted in higher flows and higher star ratings. The interests of the asset manager correspond to the investor.

In part 2 of this article, we will talk about the remaining findings.

:quality(80)/cloudfront-us-east-1.images.arcpublishing.com/morningstar/5FNGF7SFGFDQVFDUMZJPITL2LM.png)

:quality(80)/cloudfront-us-east-1.images.arcpublishing.com/morningstar/EOGIPTUNFNBS3HYL7IIABFUB5Q.png)