After Trump's election, many strategists dusted off the broad outlines of Trump's policies and discovered that a few of them might help the economy in general and some businesses in particular. He wants to cut taxes, is not fixated on cutting costs, and has shown interest in more infrastructure spending. Except to bond investors, that didn't seem like a bad idea. He had also talked about less regulation, particularly Dodd-Frank regulations, and that made many financial types very happy. And maybe the energy industry wouldn't feel quite so under the gun.

However, conveniently forgotten were trade policies that are likely to provoke at least some retaliation, and immigration policies that might limit labor force growth, which is one of the pillars of GDP growth. In addition, the stimulus plan could create more inflation, which was already on the rise without the help of Trump. And, of course, there is the issue of implementing his policies, which a lot of new presidents have found surprisingly difficult.

Trump Will Likely Inherit an Economy That Is Losing Steam

I believe that the exact policies and winners and losers will prove to be just about as difficult to predict as who would win the current election. And even if all of those were clear, a lot of that would be priced into stocks and bonds. However, it is clear that a lot of clouds, perhaps not storm clouds, were gathering over the U.S. economy. A few weeks ago, we ran a chart of industries that were driving the economy and were clearly past their prime. We believe that erosion continues. The auto industry got some more bad news as Ford announced that it would temporarily idle four North American plants for varying periods during the fourth quarter. That could involve as many as 9,000 workers in the U.S. and 4,000 in Mexico. Auto sales appear to have peaked out, but production remained relatively aggressive until recently. Cutbacks in the auto industry will slowly trickle back to a lot of supplier industries. We note the weekly chain-store sales have shockingly gone into negative territory on a year-over-year basis. Business-related construction spending also looks worse than we had hoped, and billing by architects, a great economic indicator, continues to worsen. More broadly, measured on a rolling 12-month basis, GDP growth has slowed from 2.9% to 1.6% and taken employment growth with it.

We have also raised concerns about accelerating inflation rates for some time. With gasoline prices failing to make their usually large autumn declines, headline inflation could approach 2% by December. Core inflation has been relatively robust for some time, but falling energy prices have masked a lot of those increases. As we have said before, large increases in inflation, no matter which categories are causing the issue or whether they are core, are the number-one killer of recoveries. Potential fiscal stimulus, on top of inflation rates that have already moved uncomfortably higher, could throw more gasoline on smoldering inflationary embers. The bond market has figured that out relatively quickly. Equity markets, not so much.

Trade Remains an Important Part of the Economy

A lot of discussion about world economic growth and numerous elections and referendums have centered on trade. Even in the relatively insular U.S., exports still comprise 12% of GDP, and that number is way up from the 5% level of 50 years ago. However, imports, with a relatively large open door in the U.S., are an even larger 20%, and also have grown.

As economists, we have generally cheered these developments as they have raised much of the world out of poverty, eliminated wasteful duplication of effort, allowed specialization that increased productivity and decreased prices, and therefore, led to faster growth. I still believe that is generally true, but am less sure that the playing field was always level. And for those left behind by shifting manufacturing/mining activities, the government turned a relatively blind eye. In some cases there was acceptance if not cheering that that dangerous, and polluting industries were driven out. However, there was little or no thought about what to do about those left behind. That lack of concern and empathy hurt the Democrats in the Rust Belt and was at least a factor in the election.

Now, with Trump in charge, it won’t be clear for some time if his objective is just to level the playing field or if he plans to take wholesale action to limit trade via tariffs or other barriers. With trade representing such an important part of the economy, as we noted above, we hope he moves carefully so as not to damage the golden goose we call trade.

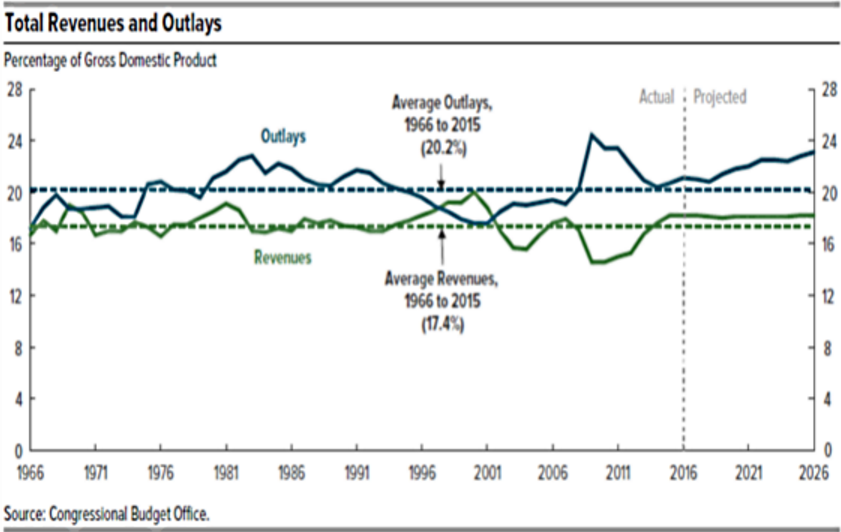

Budget Worries Could Keep a Lid on Trump’s Grand Plans

Rising government debt remains a major concern and could limit some of Trump’s options. Trump has repeatedly offered up tax cuts and alludes to more stimulus measures, which will potentially drive budget deficits higher than they already are. He does offer that better growth and less regulation could easily limit the damage. We aren’t so sure. Mainly because of Medicare, Medicaid, and Social Security, the debt can’t help but get worse over the next decade, even without any other dramatic increases in other categories of spending. The chart below spells out that dilemma. Spending looks destined to hit a budget-busting, non-war period record 24% of GDP.

I have often found that when you can "prove" with a lot of charts and tables that things can only get worse, most of that data has been factored into markets. Conclusions based on a few key indicators turning, while others are mired in the mud (or glued to the ceiling) often prove to be more correct. One of those rare bullish indicators at the moment is the stock market. Many would have you believe that they predict the economy, which helps them project the stock market. The reality is, stock-market turns almost always beat economists to the punch.

Though Trump is no Ronald Reagan, on a platform of tax cuts and less regulation, the economy managed to fare pretty well, in what some view as the good old days of the 1980s. We note the contrast between the two is strong and wouldn't use the trajectory of one to project the other. But it does say the unexpected can and does happen.

©2016晨星有限公司。版權所有。晨星提供的資料:(1)為晨星及(或)其內容供應商的獨有資產;(2)未經許可不得複製或轉載;(3)純屬研究性質而非任何投資建議;及(4)晨星未就所載資料的完整性、準確性及即時性作出任何保證。晨星及其內容供應商對於因使用相關資料而作出的交易決定均不承擔任何責任。過往績效紀錄不能保證未來投資結果。本報告僅供參考之用,並不涉及協助推廣銷售任何投資產品。

:quality(80)/cloudfront-us-east-1.images.arcpublishing.com/morningstar/5FNGF7SFGFDQVFDUMZJPITL2LM.png)

:quality(80)/cloudfront-us-east-1.images.arcpublishing.com/morningstar/EOGIPTUNFNBS3HYL7IIABFUB5Q.png)