Country Strategy

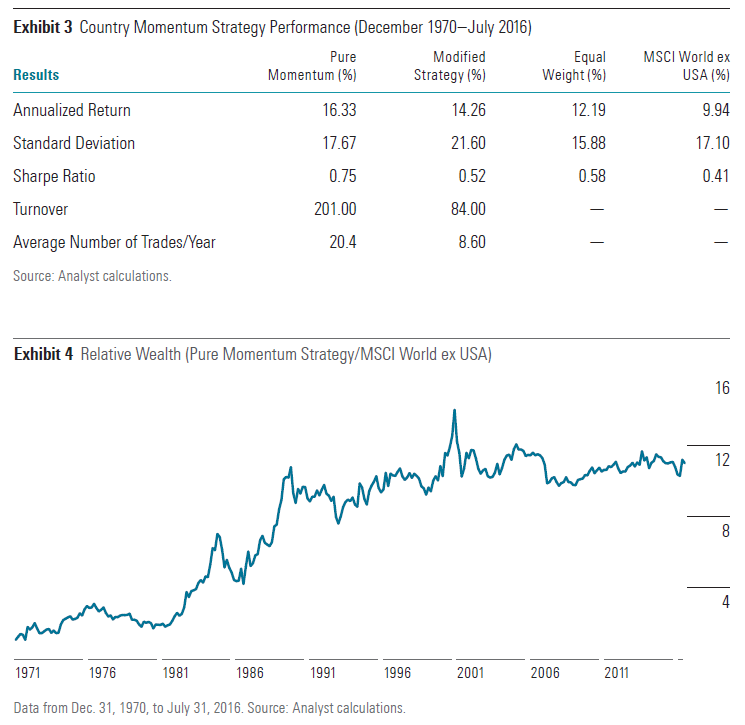

Investors could apply a similar strategy using single country index funds in their foreign-equity allocations. For this analysis, I included the MSCI country indexes for all members of the developed-markets MSCI World ex USA Index with a December 1969 inception date. This left 17 country indexes. Each month from December 1970 through July 2016, I ranked these indexes by their returns for the previous 12 months and selected the five with the best returns. The same weighting and rebalancing approach described for the sector strategy applies here. As before, I also ran a modified version of this strategy. This version refreshes quarterly and applies a buffer rule that favors existing holdings that rank in the top seven of the 17 indexes.

The pure momentum strategy significantly outperformed the market-cap-weighted MSCI World ex USA Index and equal-weighted portfolio of the 17 country indexes. The consistency of its (back-tested) outperformance is surprising, though there have been rough patches, such as the first half of 2009. And it would have required 20.4 trades per year on average. The modified version of the strategy didn’t work quite as well, but it still posted a higher return than its benchmarks, albeit with greater volatility. And similar to the modified sector strategy, it required less than half of the original’s turnover.

Asset-Class Strategy

Momentum is also alive and well at the asset-class level. But its ever-changing risk profile can make it difficult to implement. But because it is shifting across asset classes, the strategy’s risk profile can change dramatically over time, which can make it difficult to put into practice. It is important to keep in mind that risk tolerance should be the primary determinant of asset allocation.

For the asset-class strategy, I included the 10 indexes listed in Exhibit 5.

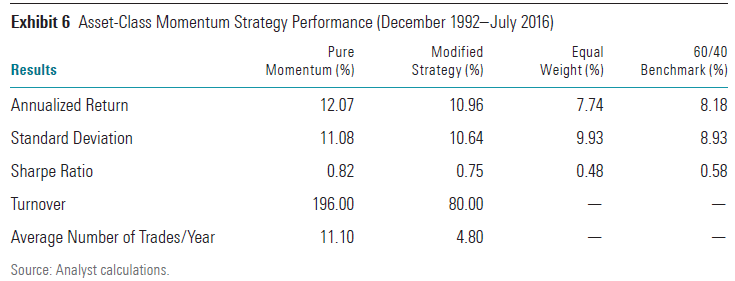

I followed the same procedure as described for the previous two strategies. But similar to the sector strategy, this strategy only held three indexes and the modified version favored existing holdings as long as their returns ranked in the top four of the 10 indexes. I ran the portfolio simulation from the end of 1992 (the earliest point at which a full year of data became available for all the indexes) through July 2016. To benchmark the performance of these strategies, I included both a blended 60/40 benchmark of the Dow Jones U.S. Total Stock Market Index and Barclays U.S. Aggregate Bond Index, and an equal-weighted portfolio of all 10 eligible indexes.

Both versions of the momentum strategy beat the two benchmarks, with greater volatility. The pure momentum strategy had a particularly strong run between 2001 and February 2009, but it significantly underperformed during the next few months and between May 2011 and March 2012. The modified version posted a smaller return edge but considerably lower turnover.

Summary

• Momentum is a short-term phenomenon that has been observed in nearly every market studied. It likely arises from three behavioral biases: anchoring, disposition, and herding.

• Investors can take advantage of momentum with funds that apply the strategy to individual stocks, or apply it directly using ETFs offering exposure to equity sectors, single countries, or individual asset classes.

• Modest adjustments to a simple ETF momentum strategy can reduce transaction costs and make it easier to profit from momentum in practice. Although momentum strategies have tended to work over the long term, they don’t always pay off.

:quality(80)/cloudfront-us-east-1.images.arcpublishing.com/morningstar/5FNGF7SFGFDQVFDUMZJPITL2LM.png)

:quality(80)/cloudfront-us-east-1.images.arcpublishing.com/morningstar/EOGIPTUNFNBS3HYL7IIABFUB5Q.png)