Investors are in hot pursuit of income in the equity market, and the trend is evident in the asset flows numbers. According to Morningstar 2016 Strategic-Beta Landscape Report, dividend-screened/weighted ETPs are the most popular flavor of rules-based passive globally. In the U.S., they represent 27% of strategic-beta assets; in Europe 43%. Several actively managed U.S. equity funds with "dividend" in their names have bucked the trend toward passive, attracting significant flows.

But flows are often a contrarian indicator. Investors pile in after an asset class has run up, only to be disappointed. This leads to a persistent gap between total returns and money-weighted return as seen in Morningstar's Investor Returns data. So now is a good time to carefully consider the attractiveness of equity-income strategies. History teaches us that if valuations are lofty, future expected returns are likely to be modest. Are we, as some have said, in the midst of a dividend bubble?

Morningstar's key dividend indexes are useful platforms for analysis. The Dividend Leaders Index is a fairly focused cohort of high-yielding stocks screened on historical dividend growth and sustainability. The Dividend Yield Focus uses the Morningstar Economic Moat rating as a forward-looking gauge of dividend reliability and also employs the Distance to Default measure to screen for financial health. Both indexes are weighted according to available dividends and are U.S.-only. Dividend Leaders yielded 3.8% as of Sept. 30, 2016, while Dividend Yield Focus' yield was 3.6%. The Morningstar US Market Index yielded 2%.

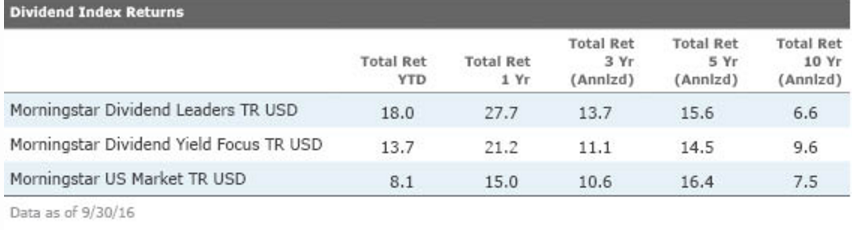

Both dividend indexes have enjoyed strong recent runs. They've outperformed the broad market for the year-to-date, trailing one-year, and trailing three-year periods through Sept. 30, 2016, though not for the five- and 10-year periods. Over the longer time periods, problems in the dividend-rich financials sector (2007-08) and more recently energy and basic materials have weighed on returns. Dividend Yield Focus' quality and financial health screens cushioned these blows.

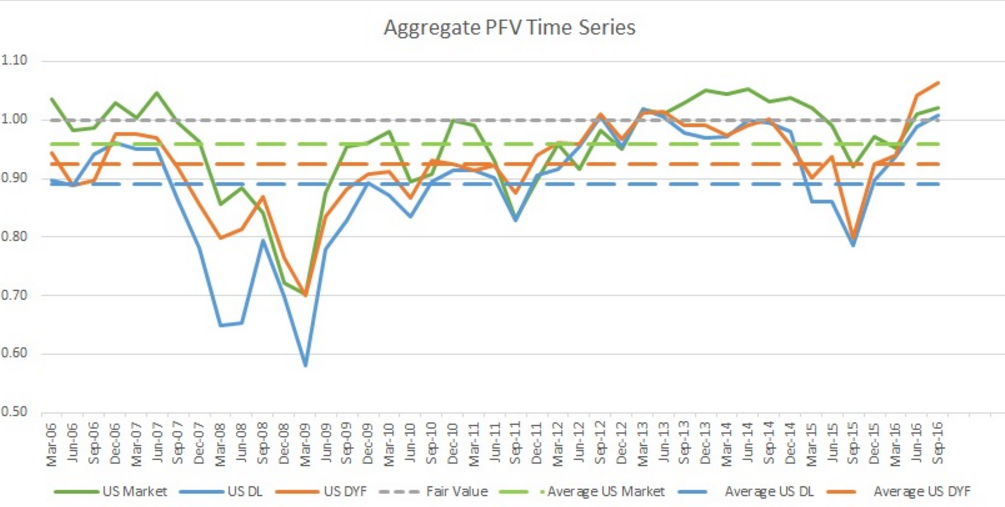

That's the past, but what about the future? Morningstar equity analysts' price/fair value estimates can be applied to index constituents to determine under-/overvaluation. According to the below graph, the Dividend Yield Focus Index was overvalued by 6% as of the end of September, while Dividend Leaders was overvalued by 1% (fair value is 1.00).

For comparative purposes it's crucial to bring in the U.S. market's valuation at this point. At the beginning of the third quarter, the Morningstar US Market Index was judged to be 2% overvalued by Morningstar equity analysts. So while both dividend indexes were overvalued in absolute terms, Dividend Leaders was less overvalued than the market as a whole, while Dividend Yield Focus was more overvalued.

Historical context is also key. Historical price/fair value estimate averages for both indexes demonstrate that Dividend Yield Focus' holdings have traded at roughly a 3% premium relative to Dividend Leaders. This could be explained by DYF's quality bias. Especially since the financial crisis, investors have preferred steady companies with entrenched positions. Interestingly, the dividend indexes have both traded at a discount to the market as a whole, on average, over the past 10 years.

To drill down further, the following graphs demonstrate index valuation by both constituent count and market capitalization. Because the indexes are weighted by available dividends, large companies that make significant dividend payments dominate. As of the third quarter of 2016, around 70% of Dividend Yield Focus' market capitalization was considered overvalued by Morningstar equity analysts; 42 of 75 constituents were overvalued. Dividend Leaders shows a roughly 60% overvaluation by market cap, while 34 of around 100 constituents were trading at a premium to Morningstar analysts' fair value estimate.

To understand why the indexes appear more overvalued by market capitalization than constituent count, consider some top holdings. Exxon Mobil, which consumed more than 8% of Dividend Yield Focus' index weight, traded at $87.40 as of Sept. 30, 2016, above Morningstar's fair value estimate of $79 per share. Cisco Systems, to which Dividend Leaders devoted 4.8% of index weight, closed at $31.67 per share at third quarter-end, above Morningstar's fair value estimate of $27. Dividend Leaders, for its part, saw two of its five top holdings attractively valued: Procter & Gamble and Pfizer.

Dividend Yield Focus' premium to Dividend Leaders suggests that quality dividend-payers ("moaty" in Morningstar's parlance) are in greater vogue than pure high-income equities. The fact that Dividend Leaders is less overvalued than the US market as a whole points to the fact that dividend bubble talk is probably overblown.

Over the long term, dividend-paying stocks are sound investments, and there's no telling how long this run of outperformance will continue. Clearly, investors are seeking income in the equity market that they are not getting from bonds or cash. But current valuations cast a shadow over the future returns of equity-income strategies as well as the U.S. market as a whole.

Gaurav Tibude contributed to this article

:quality(80)/cloudfront-us-east-1.images.arcpublishing.com/morningstar/5FNGF7SFGFDQVFDUMZJPITL2LM.png)

:quality(80)/cloudfront-us-east-1.images.arcpublishing.com/morningstar/EOGIPTUNFNBS3HYL7IIABFUB5Q.png)