On 1 November 2016, we unveiled Morningstar Analyst Ratings for more than 250 exchange-traded funds listed around the world, including over 30 ETF listed/cross-listed in Asia. While this first batch of rated ETFs already accounts for a big portion of the global ETF market—over US$1.75 trillion in assets worldwide as of the end of September—we expect to assign Analyst Ratings to dozens more ETFs in the months ahead.

Background

The Analyst Rating—which follows a Gold, Silver, Bronze, Neutral, and Negative scale—is forward-looking. It expresses our analysts’ conviction in a fund’s ability to beat its peers after accounting for fees and risk over a market cycle.

We’ve been assigning Analyst Ratings to mutual funds for about five years but with this launch we’re extending the ratings to ETFs as well. Using the Analyst Rating, we believe investors can make sounder decisions about which ETFs to choose or avoid.

Because the Analyst Rating we assign to ETFs follows the same methodology that we use to assign ratings to traditional mutual funds, it should also make it easier for investors to compare ETFs against relevant mutual funds. That practice has grown more commonplace in recent years as ETFs have become more widely available and the popularity of low-cost, passive investing has taken hold.

A Rating with Purpose

The purpose of Morningstar’s qualitative, analyst-driven research on funds is to identify those funds that we believe should be able to outperform a relevant peer group, within the context of the level of risk taken, over a market cycle.

The pillars of our analysis are the same regardless of whether we are rating a passive ETF or an actively managed fund—those pillars being People, Process, Performance, Parent, and Price. However, their relative impact on our overall assessment of a fund differs somewhat when it comes to analyzing and rating ETFs.

Obviously, keeping costs—both explicit (the ETF’s expense ratio) and implicit (that is, the cost of portfolio turnover)—at a minimum is paramount in the context of running an index-tracking fund. As such, it should come as no surprise that the top-rated ETFs that we analyze are not only among the lowest-cost options in their Morningstar Categories when compared with their actively managed peers, but also versus other passive funds.

Although costs are critical, they are just one component of our holistic assessment of ETFs. We also closely scrutinize an ETF’s performance relative to peers in its Morningstar Category. And, as part of our Process Pillar assessment, we carefully analyze an ETF’s underlying benchmark to understand how the portfolio is built and maintained as well as the techniques that the ETF’s managers employ to track the index with precision.

Stewardship also plays a vital role in our analysis. We tend to favor parent firms that put investors' interests ahead of commercial goals and that align fund managers' incentives accordingly. Of course, the skills and experience of the people managing the ETF are an important factor in our analysis. In the management of ETFs, every 0.01% of performance counts, so it is vital to have a seasoned team in place. Thus, we evaluate these matters as part of the People Pillar assessment we conduct.

In sum, we reserve our Morningstar Medalist ratings for those low-cost ETFs that we believe will tightly track a sensibly constructed index over a long time frame. We favor those ETFs backed by experienced managers and sponsored by firms that are good stewards of investors' capital. And we do so because we believe these attributes are likeliest to translate to outperformance when compared with a relevant peer group over a market cycle.

The Tally

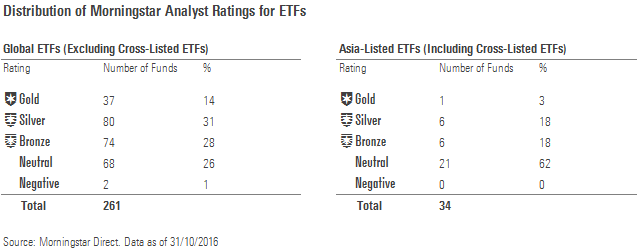

Of the 250-plus ETFs that we’ve rated across the globe, nearly three fourths are Morningstar Medalists. This number is lower for Asia-listed ETFs, with just over one-third are Morningstar Medalists out of the 30-plus ETFs that we have rated. We have a positive view of these funds’ prospects relative to their Morningstar Category peers. The positive skew largely reflects what we’ve chosen to cover. In deciding which funds to cover, we take into consideration funds’ investment merit and investor interest. Thus, our first wave of rated funds represents some of the largest, most broadly diversified, and lowest-cost funds—many of which are backed by top-rated stewards of fund shareholders’ capital.

But indexing is not always a prudent strategy. This is particularly the case when ETFs and index funds fail to deliver on the key principles that have driven much of their success: low costs and broad diversification. Many of the funds in our initial rated universe fall short on one or both measures. This is reflected in the fact that just over one fourth of the funds in our initial rated universe have received a Neutral rating, while two funds have been rated Negative.

Conclusion

Most investors do not have a black or white, active or passive view of the world. In fact, many are becoming increasingly strategy- and vehicle-agnostic, looking to select best-of-breed approaches to portfolio construction irrespective of where they are located on the active-to-passive continuum or whether they’re a fund or ETF. They are simply looking to select the type of vehicle that best meets their needs. This is evidenced by the continued growth of assets under management in ETFs around the world.

We expect that these trends will only continue, and potentially accelerate over time, driven by a combination of investors’ growing familiarity with the ETF wrapper, continued expansion of the menu of ETFs, as well as regulations such as the Department of Labor’s fiduciary rule in the United States, the Retail Distribution Review in the United Kingdom, and the Future of Financial Advice in Australia.

By incorporating ETFs into our Analyst Rating framework, we are leveling the field to help investors to pick the best funds from an ever-expanding list of choices.

:quality(80)/cloudfront-us-east-1.images.arcpublishing.com/morningstar/5FNGF7SFGFDQVFDUMZJPITL2LM.png)

:quality(80)/cloudfront-us-east-1.images.arcpublishing.com/morningstar/EOGIPTUNFNBS3HYL7IIABFUB5Q.png)