There were a lot of data last week (1-5/AUG) but the employment report was all that really mattered. The U.S. market had slipped in seven of the past eight sessions through Thursday as slowing GDP growth weighed on investors' minds. However, the market rallied about 1% on Friday as the second exceptionally strong employment report in a row cast some doubt on the glum second-quarter GDP report. When the two reports diverge it is often the employment report that gets it right. That's why most of this week's report is focused on employment data.

Employment Data Tells Two Different Stories, Depending on Your Time Perspective

Comparing the July employment report to the June employment report, there was a lot to like. With 255,000 jobs added in July, the report was well above the consensus of 185,000 jobs and the 12-month average of 204,000. Furthermore, adjusting for the Verizon striking workers' return to work, the 255,000 workers added was every bit as strong as the June report, making for a strong back-to-back performance.

The breadth of improvements across sectors was also unusually good, with only for-profit education losing much ground relative to recent trends. The mix of jobs added was biased to high-paying jobs that combined with underlying worker shortages and a bump in some state minimum wages drove average weekly wages up by 0.3% month to month and 2.6% year over year. Adding to the good news, employment growth was revised modestly higher for May and June.

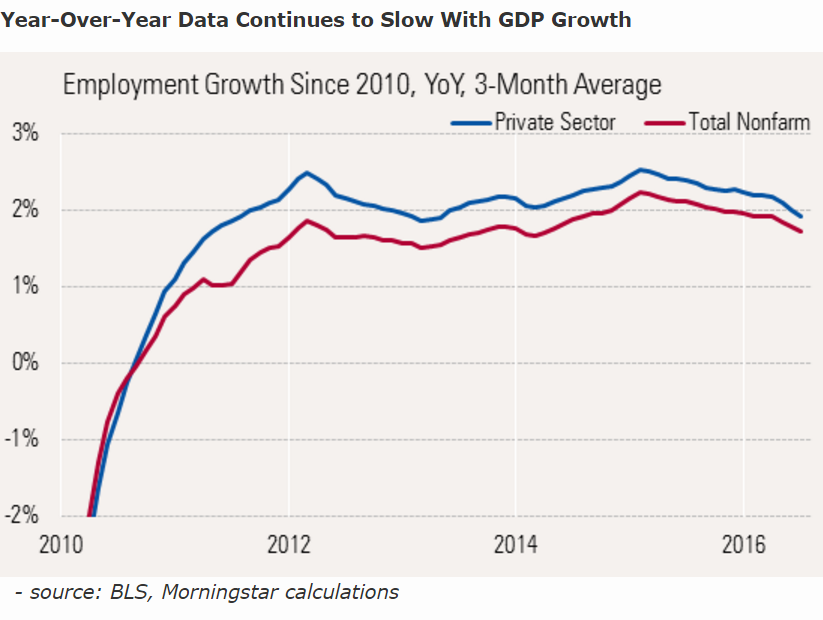

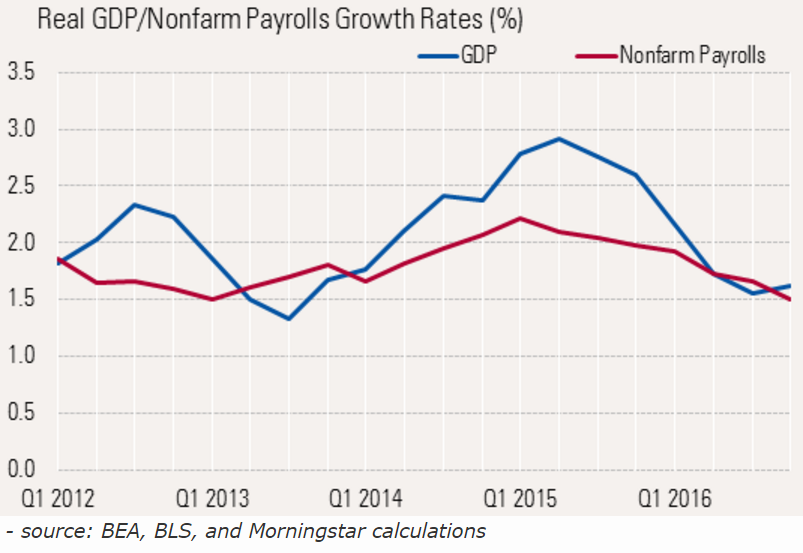

Employment Growth Slows With GDP

Despite the good news of the past two months, the trend is toward continued slowing in employment growth. In a world of limited growth, a move from 2.1% employment growth last July to 1.7% is nothing to sneeze at. And given the tough comparisons with a year ago (when payroll growth was inexplicably soft), some further deterioration in the year-over-year growth rate might be possible. Over the same time frame GDP grew 2.9% to 1.7%, which explains why employment growth has slowed, far above the recovery average of 0.3%. With the new revised GDP data, it appears that GDP growth exceeded employment growth by a wider-than-average spread in 2015, approaching 1% at one point. That spread has currently all but disappeared. We suspect that spread will stabilize around current levels, effectively rebalancing the 2015 anomaly. From the consumers' point of view, slowing in employment growth is being offset by faster hourly wage growth.

While employment growth has slowed from 2.4% last July to 1.9% currently while wages growth has accelerated from 2.2% to 2.6%, offsetting most of the damage to consumer wages. However, hours worked are still behind the year-ago rate, holding back total wage growth. I think this data answers a key question: Is job growth and GDP growth being held back by a lack of workers, or a lack of jobs? With wages accelerating at a time fewer workers are being hired, the answer is clear to us. Most telling to us is that manufacturing employment is basically flat with year-ago levels and manufacturing hourly wages are up 3%, more than the average hourly wage growth rate of 2.6%, indicating scarcity worries.

However, not all of the wage growth is necessarily due to shortages. Higher minimum wages are maybe at work, too. The second-best performing wage was the leisure and hospitality sector, which employs a large number of minimum-wage employees. That higher wage has enticed more people to enter the work force as the participation rate has increased again recently. It also appears that with higher wages, employers are finding ways to cut back on hours. For example, weekly wages in the leisure and hospitality sector were up only 3.2% even as wage rates went up 4% because of fewer hours worked.

Wage Rate May Be a Bigger Issue/Help Than the 2.6% Annual Wage Rate Growth Suggests

Wage growth has been accelerating modestly but is still quite high by recent standards and considering very modest inflation rates (mainly due to energy prices and imported hard good prices). Still, that modest growth may appear much less modest to many employers. Slow wage growth in the retail sector and the mining sector and a quirk in the education and health growth rate (the increasing ratio of lower-skilled health workers to highly skilled, highly paid workers is holding back the "average" wage) may be suppressing the overall average. Without these special factors the wage growth rates may have been closer to 3%. Again, this is great news for the consumer and consumer spending, but not such great news for business and corporate profits and inflation. Seven of the 13 industry categories, featured wage rate growth of 3% or higher.

The Solutions to Growing the Economy Faster Are Clear, and Central Bankers Are Not One of Them

We believe that a shortage of properly trained and located workers is what is holding back the economy. A combination of accelerating wage growth, low unemployment rates, near-record levels of job openings, and the record number of unfilled positions reported at small business leads us to that conclusion. It appears that higher wages are one solution as higher wages and better prospects seem to be luring more workers back into the work force. Participation rates have stabilized or moved higher as wage rates have increased. Recent wage growth may explain why consumption was the bright spot in an otherwise bleak GDP report.

We are not sure that higher minimum wages are the best way to accomplish that, but businesses have been too focused on lower wage rates. Unlike Henry Ford, who realized he needed to pay workers at a rate high enough to afford the purchase of the cars they manufactured, many businesses were ruthless in pursuit of lower wages. That may have hurt productivity and morale more than it helped profits. Furthermore, lower wages might have helped individual companies, but as many pursued that same strategy, it slowed overall wages. That in turn hurt the market for the goods that they and others were selling. Shifting demographics with massive baby boomer retirements and the disappearance of the large pool of unemployed workers from the Great Recession will now make the low-wage-at-any-price strategy self-destructive to one's own business.

Better training for workers could also be part of the solution. We hope that training might come from the private sector, but some targeted programs from the government might not hurt, either. Also, business or government incentives to encourage employees to stay in the work force longer may alleviate some of the labor issues today. These--and not easier monetary policy--seem to be what the economy needs now.

©2016晨星有限公司。版權所有。晨星提供的資料:(1)為晨星及(或)其內容供應商的獨有資產;(2)未經許可不得複製或轉載;(3)純屬研究性質而非任何投資建議;及(4)晨星未就所載資料的完整性、準確性及即時性作出任何保證。晨星及其內容供應商對於因使用相關資料而作出的交易決定均不承擔任何責任。過往績效紀錄不能保證未來投資結果。本報告僅供參考之用,並不涉及協助推廣銷售任何投資產品。

:quality(80)/cloudfront-us-east-1.images.arcpublishing.com/morningstar/5FNGF7SFGFDQVFDUMZJPITL2LM.png)

:quality(80)/cloudfront-us-east-1.images.arcpublishing.com/morningstar/EOGIPTUNFNBS3HYL7IIABFUB5Q.png)